By Mr. RAJESH MENON, Associate Director & Maritime Expert at GOI / Visiting Faculty-Maritime.

Container ships today handle nearly 16 per cent of the world’s maritime trade — from 37 million twenty-foot equivalent units (TEUs) in 1980, the volume of containerised trade surged to 850 million TEUs by 2023. Gearing up to handle these massive quantities of containers, ports around the world have bulked up their infrastructure and transformed into mega ports. In 2021-22, Shanghai port led by handling 44 million TEUs, followed by Singapore with 37 million TEUs, Zhoushan (34 million TEUs), Shenzhen (25 million TEUs), and Busan (20 million TEUs).

Clearly, Chinese ports have the edge, cumulatively handling 250 million TEUs, against which India’s 20 million TEUs pales in comparison. Among Indian ports, JNPT and Mundra Port together handle more than half of the country’s containerised trade volume.

While India’s share of containerised trade is increasing alongside the global growth, it continues to grapple with shortfalls in productivity, turnaround of ships, utilisation of berths, and technology enablement.

Private investors

India’s 7,517-km coastline extends across nine states and four Union territories. The central government manages 12 ports, known as major ports, while the state governments manage non-major ports — 217 in all — under a directorate of ports in the respective industry departments or a maritime board. Post liberalisation in 1991, the major ports worked under a ‘landlord’ model by leasing out the waterfront and terminals to private operators on a public-private partnership (PPP) basis; state ports, on the other hand, leased out their waterfront to private investors mostly on a build-operate-transfer basis under a PPP, through a model concession agreement that was conceived in 2008 and amended in 2022.

In recent years, the government has initiated policy measures to attract private investments in the ports sector, including allowing 100 per cent foreign direct investment (FDI); offer of income tax incentives; and permitting joint ventures between major ports and foreign ports, non-major ports, and private companies.

Currently, the country has 76 functional ports — 12 major and 64 non-major — and nine more are under development. The total cargo handling capacity countrywide is about 2,700 million tonnes per annum (MTPA) with 60-65 per cent utilisation on average.

The growing Indian economy and trade, wherein 95 per cent of export-import cargo volume is shipped, necessitates an expanded port capacity. Further, as ship sizes continue to increase, we need ports that can accommodate them. Our ports with high-volume cargo handling capacity have an average of 8-12 m draft. Bigger vessels require at least 12-20 m draft. This will also enable big mother vessels to call at our ports, helping reduce logistic costs and avert the need for transshipment.

New development

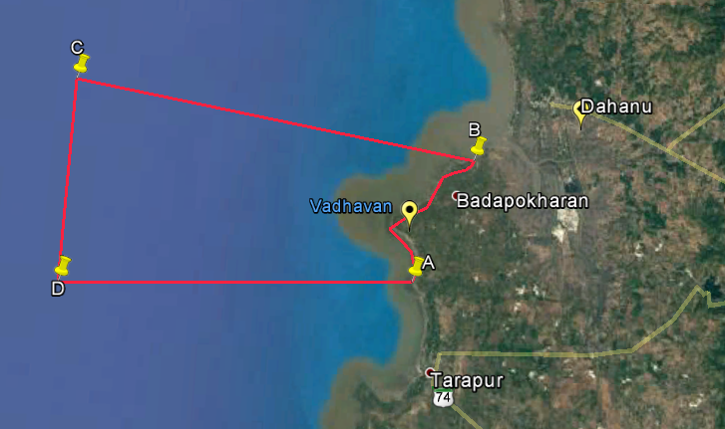

In this context, the approval for the setting up of an all-weather, deepwater mega port at Vadhavan, near Dahanu, in Palghar district of Maharashtra, assumes importance. A special purpose vehicle (SPV) created by Jawaharlal Nehru Port Authority (JNPA) and Maharashtra Maritime Board (MMB) with a shareholding of 74 per cent and 26 per cent, respectively, will develop the port at an estimated cost of ₹76,220 crore. The development of the core infrastructure, terminals, and other commercial infrastructure will be in PPP mode.

Road connectivity between the port and national highways has been approved by the Ministry of Road Transport and Highways, while linkage to the existing rail network and the upcoming Dedicated Rail Freight Corridor has received the nod from the Ministry of Railways.

The port will have nine container terminals, each 1,000 m long; four multipurpose berths, including a coastal berth, four liquid cargo berths, a berth for roll-on, roll-off or Ro-Ro ships, and a Coast Guard berth. The 20-m draft, capable of berthing large vessels, will be created through reclamation of 1,448 hectares from the sea. The plan is to create a cumulative cargo handling capacity of 298 MTPA, including around 23.2 million TEUs of container handling capacity.

The port will cater to hinterland industrial areas in Maharashtra, south and north Gujarat, Rajasthan, National Capital Region, Madhya Pradesh, Chhattisgarh, and other central and north Indian states, With several multimodal logistics parks coming up in Pune, Wardha and other parts of western and central India, and the proximity to the Dedicated Rail Freight Corridor (12 km) and the upcoming Mumbai-Vadodara expressway (22 km), the port’s location holds strategic commercial significance.

As India strives to transform into a developed nation by 2047 and the third-largest economy, ports will play a vital role in achieving this goal. Greenfield ports with deep draft and high capacity are the need of the hour when we dream of ourselves as a blue economy. The development of the Vadhavan port is a major step in that direction.

Author :

Mr. RAJESH MENON, Associate Director & Maritime Expert at Government of India / Visiting Faculty-Maritime