“We need you to send a picture of the driver’s CDL, as well as a picture of them in front of the truck with the MC and DOT# clearly visible,” a broker wrote to small fleet owner-operator Gabriel Scott, according to his recent LinkedIn post. “I need your driver to write ‘1426’ on paper or anything available and hold it up while in front of the truck. Once I have these we can move forward.”

Bear in mind this is a broker with whom Scott had already onboarded and moved freight.

“It is just pathetic that after Highway verification, ELD accessibility, live driver tracking and 3am phone calls, carriers/drivers still have to go this length before securing a load,” wrote Scott.

All that hassle came from the owner trying to book a 250-mile load at a “little over” $2.70/mile, after some negotiation. Scott suggested the driver could complete a TikTok challenge in a selfie video to prove to the broker he’s a real operator and not a fraud.

Maybe that’s an extreme example, but it’s also true. In the midst of a freight “fraud apocalypse,” as TIA’s leader Anne Reinke calls the situation in brokered freight markets today, brokers and carriers have resorted to extreme measures to stop fraudsters from gaining access to freight.

“Roughly between 2021 and 2022, cargo theft changed forever,” said Scott Cornell, Transportation Lead and Crime and Theft Specialist at Travelers and a leading voice on fraud, particularly the kind that results theft of loads. During those heady days of sky-high rates, a COVID-induced industry-wide rush to tech connectivity in the spot market created perfect conditions for international crime rings to swoop in.

The result hasn’t been pretty.

According to the Truckstop load board’s ongoing tracking of identity theft, double brokering and other types fraud in the freight marketplace, the number of instances surged 33% in Q1 of 2024 and 46% on top of that in Q2.

From Q1 of 2022 to Q1 of 2024, CargoNet saw an astounding 1,445% increase in cargo theft events, with each stolen shipment worth around $200,000, said Cornell.

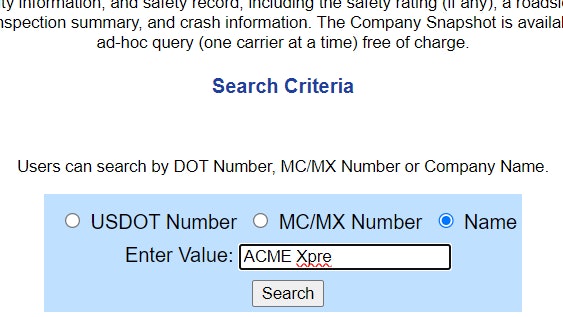

Over that same two-year period, however, the “carrier vetting” industry has risen up with the stated mission of rooting out fraud in freight transactions. There’s Highway, Carrier Assure, Verified Carrier, and Freight Validate, in addition to older services aimed at brokers like those of carrier-review site Carrier 411 and the major load boards’ monitoring services CarrierWatch (DAT) and RMIS (Truckstop). That’s by no means all such services (Truckstop’s out with another in the Risk Factors service launched about a month ago). All variously brand themselves as critical solutions to stop fraudsters in their tracks, and many operate by mining, interpreting and delivering otherwise public carrier data.

What do the owners and operators in Overdrive‘s audience think about brokers’ new requirements and the companies that now stand between them and brokered loads? Not much. With 825 responses to our recent survey, fully 64% said carrier vetting services have done nothing good for the trucking business.

With some pretty glaring specific examples of Carrier Assure’s long refusal to grade some expedited carriers anything besides “F” despite consistent protests, and owner-operators speaking up about being nearly run out of business simply because they have a new authority or no inspections, it’s easy to see why carriers have a negative view of vetting companies.

The second question in the survey showed just 4% of owner-operators (among more than 700 respondents) felt vetting services were making brokers better at catching bad actors — and just 2% see opportunities to shine for small carriers.

But truckers aren’t alone in thinking carrier vetting has a long way to go.

The idea that these companies can meaningfully end cargo theft or double brokering despite the problem only getting worse represents “total BS,” Frank Matarazzo of Fusion Transport, a New Jersey-based mid-sized brokerage.

“They can’t tell you that there’s one single silver bullet that stops cargo theft,” he said. “It takes a multitude of steps that need to be conducted, mostly on the ground when the truck shows up.”

Shippers need to check who the truck is registered to, who is the driver on the policy, who the trailer is registered to, and a dozen other “little granular things that never used to matter,” said Matarazzo.

That said, Matarazzo does pay for not one but several carrier vetting services, and most of the brokers Overdrive spoke to while researching this topic also subscribe to a few.

“I have subscriptions with RMIS, Carrier 411, and a few others like MyCarrierPortal,” said Matarazzo. “These carrier vetting systems help us set criteria for onboarding new service providers or carriers. While they’re not foolproof and can sometimes be circumvented, they are valuable tools.”

According to Matarazzo, one reason behind the rise of carrier vetting software systems is that brokers’ shipper customers “often inquire about our vetting process and how we maintain carrier status over time.”

Silver bullet or not, if a stolen load is worth an average $200,000 to a broker and its customer, and a carrier vetting subscription costs even $2,500 a month, as some services do, then it only needs to stop one instance of theft in a year to more than pay for itself.

“They’re an important part of our overall playbook, but they’re not the ultimate solution,” Matarazzo said.

Previously, small fleets and owner-operators told Overdrive brokers need an education on what makes a trucking company a real, not fraudulent operation. Expedited sprinter van fleets won’t get inspected. Plenty of other legitimate Class 8 trucking companies won’t show inspections on their record, either.

[Related: Brokers circling the wagons, shutting carriers out of freight]

Cargo theft expert Cornell seconded the motion for an educational campaign among brokers.

“You can’t just go out and hire one of these solution providers and think, ‘I’m set,'” said Cornell. “I know people who have gone out and purchased [carrier vetting programs] and still have a theft and say ‘Well, we use XY company.'”

“OK, you use them but did you let them do their thing?” Cornell typically responds. “Did you have good processes and procedures around that or did you override them?”

The vast majority of time, the broker’s bypassed the vetting company’s grading or their own procedures around vetting, leading to fraud or theft, he added.

“Human error remains part of the problem — self inflicted pain,” said Cornell.

Truly, carrier vetting represents a new cottage industry. There’s even a new upstart company called Carrier Defender which will dispute false FreightGuard reports on carriers’ behalf, noting that black mark alone could deal a death blow to a small carrier. Yet even though big companies probably spend thousands a month, just two years into the industry’s ascension to prime time, many rank-and-file brokers don’t know how or when to employ it.

[Related: Carrier Defender goes after false FreightGuard reports]

Like other products, different offerings run the gamut from extremely thorough, like Freight Validate using facial recognition or Verified Carrier checking in on your banking information, to surface level, like Carrier Assure scraping public data to produce a letter grade.

Overall, Cornell said brokers should turn to vetting software and said his team at Travelers spends a good deal of time training them on proper use.

[Related: Broker intrusions on the rise with ubiquitous location tracking]

But the fight between police and thieves rarely ends in stalemate, and even as brokers get advanced tech tools to root out fraud, the problem just seems to metastasize. One major driving force behind that remains the market for carrier and broker MC numbers.

Cornell said some carriers or brokers with a seasoned authority — that is, one onboarded with lots of brokers and/or with a history with shippers — might sell their authorities for up to $30,000 if they’re willing to throw in the phone number and email address associated with the MC.

“One thing cargo thieves are very good at is return on investment,” said Cornell. After all, if they can pay $30,000 to steal a load worth $200,000, that’s a good buy.

MC number sales, or their theft through identity fraud, tear a hole in the carrier vetting industry’s shield against fraud and theft that’s big enough to drive a truck through. Cornell said some of the more data-intensive approaches, like Verified Carrier’s, can help spot these sales and thefts, but that’s because that particular service goes as far as to check banking information to make sure payments match with the names and entities being presented to the freight broker.

How would you feel about logging into your bank account to show a broker you’re vetted? One carrier we spoke to who dealt with Verified Carrier simply refused to.

[Related: Carrier vetting gone wild: $300 verification fee to get paid for a load?]

For now, instances of fraud generally, and cargo theft particularly, just continue to grow even as carriers and brokers take increasingly onerous steps to prevent it. FMCSA’s recent changes to its registration system and a planned system-wide audit might be the only truly promising development on the horizon.

Otherwise, owner-ops might prep to complete some TikTok challenges for the next load.