Class 8 truck orders were down in January, as buyers contemplate the impact tariffs will have on both truck prices and freight levels.

The spot market saw falling rates for van and reefer carriers, meanwhile, but were in line with normal seasonal movements.

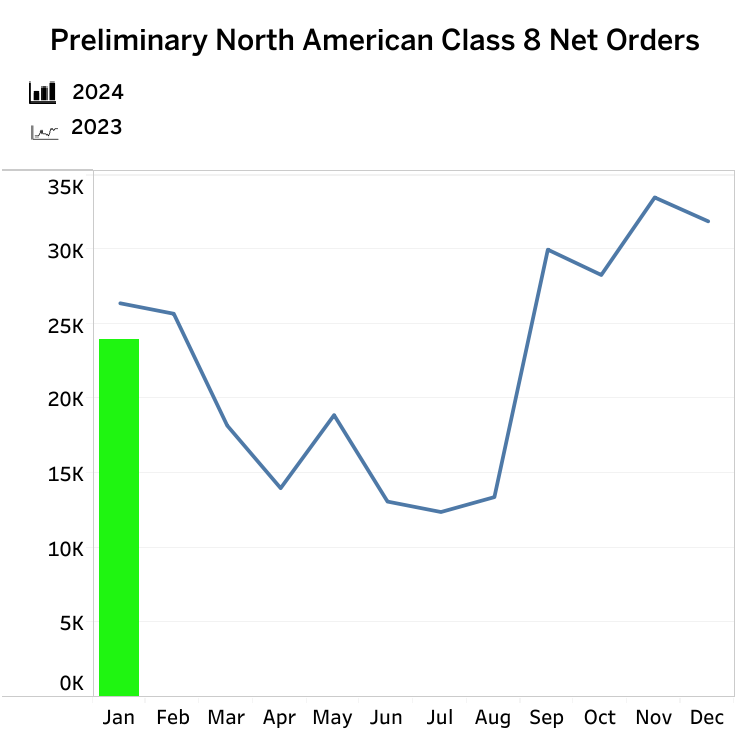

Class 8 orders open year on soft note

Preliminary Class 8 orders for January totaled 24,000 units, according to FTR, down 28% from December and 15% year over year.

These were short of expectations, and well below the seven-year January average of 27,850 orders, FTR reported. Weak orders could be the result of the looming threat of tariffs and uncertainty among buyers.

Vocational truck orders were flat, while the on-highway market suffered the bulk of the decline.

“A 25% U.S. tariff on imports from Canada and Mexico – currently paused for trade negotiations through early March – and a 10% tariff on Chinese imports as of Feb. 4 could significantly increase costs for North American Class 8 trucks and parts if fully implemented and enforced indefinitely,” warned Dan Moyer, senior analyst, commercial vehicles.

“With roughly 40% of U.S. Class 8 trucks built in Mexico and around 65% of Canada’s Class 8 trucks built in the U.S., tariffs and likely counter-tariffs threaten to disrupt supply chains and drive up vehicle prices. Combined with upcoming U.S. EPA27 NOx regulations, tariffs could accelerate or delay fleet upgrades. While OEMs and suppliers may explore shifting production to mitigate potential tariff impacts, such changes are complex and will take some time to implement. Ongoing trade negotiations and policy uncertainties may already be influencing investment decisions and long-term planning for fleets, OEMs, and suppliers.”

ACT Research reported 25,800 orders, but pointed to an overall strong market.

“While January orders took a step down from the recent trend, strength continues to be the applicable descriptor of Class 8 order activity. In January, Class 8 orders dropped 5.1% year over year to 25,800 units,” said Kenny Vieth, ACT’s president and senior analyst.

“While down narrowly from last January, orders were down 30% against a seasonally stronger December.”

Regarding medium duty, he added, “Medium-duty Classes 5-7 orders continue their slowly deflating trajectory into still historically elevated truck and bus backlogs. ACT’s preliminary look at January North American Classes 5-7 orders puts the month’s volume at 15,100 orders, down 21% y/y and 10% below December’s intake.”

Spot market van rates normalizing

Dry van and reefer spot market rates in the U.S. fell the week ended Jan. 31, but were in line with normal seasonal movements. Flatbed spot rates rose, according to Truckstop and FTR Transportation Intelligence.

For dry van haulers, it was the steepest drop in nearly a year and they now sit at their lowest levels since U.S. Thanksgiving. Flatbed rates rose the most since October and are at their highest levels in 14 weeks.

“The spot market is transitioning from a period of the year when van spot rates reliably decline absent weather impacts into one that is more variable. The tariffs announced on Saturday could potentially disrupt spot metrics this week, although it is unclear in what direction if it has any effect at all,” the companies reported.

With truck postings outpacing load postings, the Market Demand Index fell to 68.8, the lowest level this year.