ACT Research reported higher trailer orders in March, while also suggesting there could be a bump in freight rates due to tightening capacity as a result of the trade war.

Flatbed rates and volumes have been soaring in the spot market, but that too could be related to the trade war and a pull-forward of imports to get ahead of those tariffs.

Spike in trailer orders

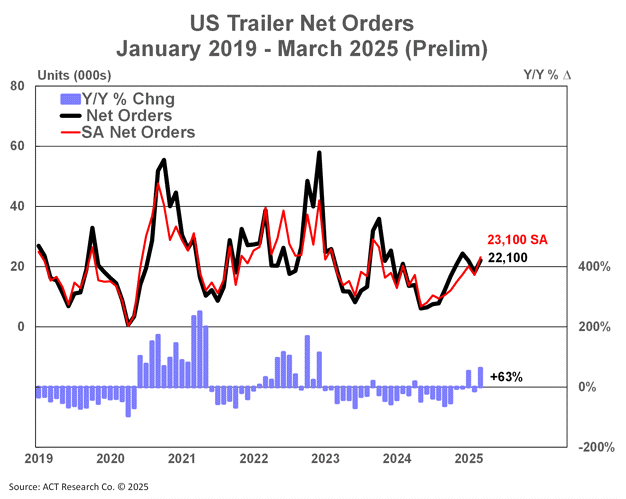

ACT Research reports preliminary net trailer orders jumped by about 3,800 units from February to March, a 21% gain.

The tally of 22,100 units was also up 63% year over year, ACT reported.

“Given that March marks the cyclical beginning of the weaker order months of the year, this month’s data certainly were a high-side surprise. That said, it is not that much of a surprise this year, amid the unprecedented environment in which we find ourselves presently, and we again caution that one month does not make, or in this case buck, the trend,” said Jennifer McNealy, director CV market research and publications at ACT Research.

She cautioned: “With weak for-hire truck market fundamentals, low used equipment valuations, relatively full inventories, high interest rates, and the ambiguity of policy shifts still in play, ACT’s expectations for subdued build and order intake levels during 2025 remain intact. While speculative, what we may be seeing in March’s data is a pull-forward of orders in advance of possible tariff-related cost increases to come. While good news for this month, pull-forward, if that is the case, means orders placed now will not need to be placed at a later date.”

A silver lining to tariffs?

ACT also put out analysis that suggests there could be a silver lining to the current trade war as it relates to the for-hire freight market.

“Even the EPA low-NOx standards initially promulgated by the first Trump administration planned to go into effect in 2027 are now under review,” said Tim Denoyer, ACT Research’s vice-president and senior analyst.

“The significant private fleet pre-buying in preparation for these rules in recent years is set to end or even reverse as tariffs hit, which is likely to reduce equipment supply. While the freight demand outlook is lower, trade and regulatory turmoil are also supply shocks, which we expect to lead to freight rate inflation later this year.”

“Shippers added to safety stocks in anticipation of tariffs, and deteriorating consumer fundamentals due to elevated uncertainty suggest the for-hire freight recession will persist near term. Consumers made extra pre-tariff purchases as well, and are likely to pull back on spending as they anticipate higher inflation.”

He concluded: “The long for-hire freight recession already led U.S. Class 8 tractor sales below replacement levels in the first few months of 2025, so capacity is finally tightening after significant expansion in recent years. This isn’t helping the for-hire market yet, but freight demand should still increase seasonally in the coming months, and tighter capacity should mitigate the negative effects on freight demand from the trade war.”

March spot market volumes soared for flatdeckers

DAT Freight & Analytics reported March spot market volumes in the flatbed segment surged 13% in March, while van volumes were up 5% and reefer up 1%. More business days and better weather may have driven some of the March gains, but year over year comparisons were also positive.

However, van and reefer rates decreased in March. Van rates fell 5 cents/mile to $1.99 (all figures USD), and reefer rates dropped 9 cents to $2.27 per mile. Flatbed rates bucked the trend, rising 8 cents/mile to $2.53.

“Tariff uncertainty was a factor, but so was tighter capacity,” said Ken Adamo, DAT’s chief of analytics. “Roughly 30% of flatbed loads move on the spot market compared to 12 to 15% for vans and reefers. The equipment and driver skills are specialized and spot-market demand is highly seasonal. When there are fewer trucks, it affects the flatbed market more than the others.”

Contract rates were consistent on the month.

“Compared to the spot market, contract pricing has been consistent for the last 12 to 15 months,” Adamo said. “That may change if tariffs and geopolitical issues disrupt supply chains and shippers turn to the spot market for available trucks. For now, though, shippers and brokers continue to hold on to pricing power.”

Flatbed rates still rising

For the week ended April 11, Truckstop reported dry van and reefer rates continue to fall, while flatbed rates climbed.

“Flatbed spot rates, meanwhile, rose for a ninth straight week – a streak not matched in the past three years – to their highest level since May 2023,” Truckstop said. “The current week (ending April 18) generally brings lower dry van and refrigerated spot rates, although upside outliers are certainly possible given that the week leads into Easter.”

Load postings on the Truckstop platform dropped for the first time in 11 weeks, with a sharp decrease in flatbed loads. The company reasons the recent run-up may be due to tariff-related pull-forward of imports.