Despite difficult freight market conditions, Class 8 preliminary order intake got a boost last month, beating seasonal expectations.

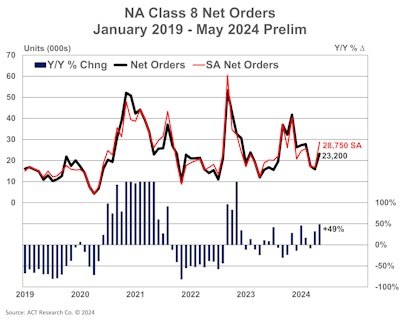

Preliminary Class 8 net orders in May were tallied at 23,200 units, according to ACT Research. This is up 46% month-over-month and 49% year-over-year.

ACT Research

ACT Research

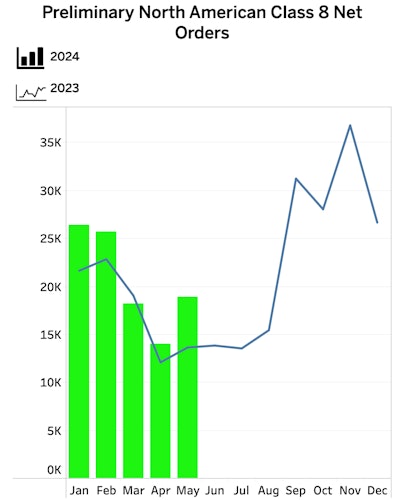

FTR Transportation Intelligence data showed that Class 8 preliminary net orders for May were at 18,900 units, which is up 25% month-over-month and 37% year-over-year. Class 8 orders for the past 12 months total 273,900 units.

According to FTR, this level of order intake is above recent demand trends and 2% above the average for the month of May over the past decade.

FTR

FTR

Though market demand typically slows down in the second quarter of the year, Steve Tam, ACT vice president and analyst, said that surprises are always lurking.

“Class 8 preliminary order intake provided May’s drama, effectively zigging when they expected to zag,” Tam said. He said that the availability of open build slots in Q3 and Q4, plus OEM’s efforts to maintain balance in anticipation of an upcoming emissions-driven pre-buy likely influenced May’s order activity.

In February, Magnus Koeck, vice president of strategy, marketing and brand management at Volvo Trucks North America, also forecasted a solid year for Class 8 sales in 2024, and noted that an anticipated pre-buy of new trucks ahead of emissions rules in 2027 would boost market activity in the second half of the year.

“The pre-buy will start earlier. We probably will see that already this year in the back half and into ’25 and, of course, into ’26,” Koeck said at the time. “’27 will be a big dip due to new emissions regulations … with quite a dramatic increase in prices due to the new regulations.”

Tam added, “While we do not have visibility at this point, the strength is presumably driven by private and vocational fleets, supplemented by an ongoing healthy appetite for equipment in Mexico.”

[RELATED: Mexico-bound Class 8 production to rise in 2024, says ACT]

OEMs are also actively filling build slots at a steady pace, said Dan Moyer, senior analyst, commercial vehicles at FTR. Besides the month-over-month increase, with orders significantly higher from May 2023, Moyer said this indicates the market remains on a solid footing despite near-term challenges. While all OEMs saw a rise in orders, vocational markets stood out as particularly strong compared to on-highway.

“Despite the trend of stagnant freight markets, fleets remain willing to invest in new equipment,” said Moyer. “Order levels slightly exceeded historical averages and seasonal expectations, and we still anticipate a replacement level of output by the end of 2024.”

Looking into the medium-duty space, Tam noted, “A picture of stability, North America Classes 5-7 net orders were 18,900 units in May, up 0.2% month-over-month, but down 6.9% year-over-year.”

Pamella De Leon is a senior editor of Commercial Carrier Journal. An avid reader and travel enthusiast, she likes hiking, running, and is always on the look out for a good cup of chai. Reach her at [email protected].