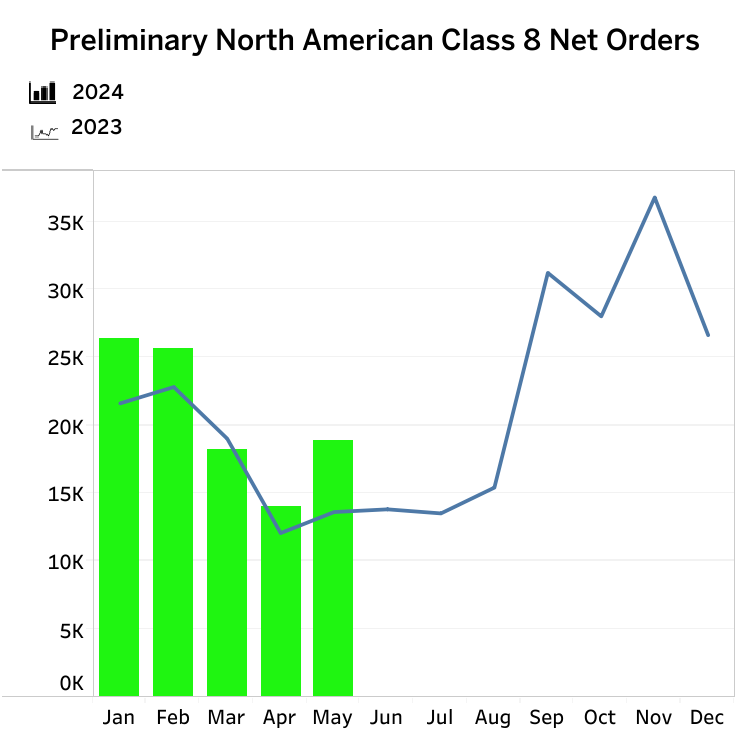

May was a strong month for Class 8 truck orders. Does it signal improving freight conditions or the beginning of a pre-buy ahead of costly EPA27 emissions regulations?

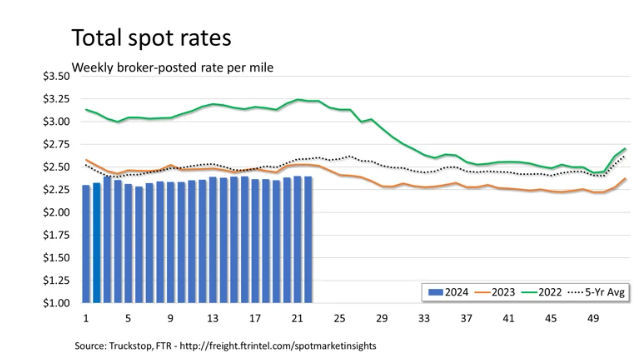

And the spot market was flat in the most recent week, but some segments were stronger than others.

Sharp uptick in Class 8 orders

Class 8 truck orders spiked in May, according to preliminary data from FTR and ACT Research. Is this the beginning of the EPA27 pre-buy?

FTR reported orders of 18,900 units, up 25% from April and 37% year over year.

“OEMs are actively filling build slots at a steady pace. Along with the month-over-month increase, the fact that orders were up significantly from the May 2023 level indicates that the market remains on a solid footing despite near-term challenges,” said Dan Moyer, senior analyst, commercial vehicles with FTR.

“While all OEMs experienced order growth, vocational markets stood out as particularly strong compared to on-highway. Despite the trend of stagnant freight markets, fleets remain willing to invest in new equipment. Order levels slightly exceeded historical averages and seasonal expectations, and we still anticipate a replacement level of output by the end of 2024.”

For its part, ACT Research reported net orders of 23,200 units, up 46% from April and 49% year over year.

“Market observers may recall that demand typically slows in Q2. However, surprises are always lurking,” said Steve Tam, vice-president and analyst.

“Class 8 preliminary order intake provided May’s drama, effectively zigging when they were expected to zag. Ample open build slots in Q3 and Q4, combined with the OEMs’ desire to achieve some semblance of balance with respect to the impending pre-buy likely impacted May’s order activity. While we do not have complete visibility at this point, the strength is presumably driven by private and vocational fleets, supplemented by an ongoing healthy appetite for equipment in Mexico.”

Spot market rates stable

Truckstop and FTR Transportation Intelligence report the week ended May 31 showed stable rates on the spot market.

Dry van rates were basically flat, while reefer rates fell the worst since the fifth week in the year. Flatbed rates were up for the third consecutive week, for the first time since January.

“While the main equipment types moved differently, the week-over-week changes each were directionally in line with the changes for the same week last year,” Truckstop reported.

Load postings fell more sharply than truck postings, so the ever-important Market Demand Index fell to 74.4, its lowest level in a month.