Crypto SWOT: Venture capital firm Paradigm has raised $850 million for its third fund

Kitco Commentaries

Opinions, Ideas and Markets Talk

Featuring views and opinions written by market professionals, not staff journalists.

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Monero, rising 5.16%.

- MicroStrategy will offer $500 million in convertible notes to acquire more Bitcoin, the third sale of the securities this year by the enterprise-software maker that has made buying the cryptocurrency part of its corporate strategy, writes Bloomberg. The largest publicly traded corporate holder of Bitcoin plans to issue unsecured senior notes due in 2032 according to a company statement.

- Bitfarms rose 14% to the highest point in almost 15 weeks. Trading volume was 2.7 million shares, quadruple the 20-day average, according to Bloomberg metrics.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Wormhole, down 36.70%.

- Bitcoin mining company Bitfarms is adopting a “poison pill” shareholder rights plan as a defense after an unsolicited takeover offer by larger rival Riot platforms. Riot made an unsolicited, $950 million offer in May to buy Bitfarms after the smaller Bitcoin miner rebuffed its takeover approach the prior month. Bitfarms said its board had determined that the proposal “significantly undervalues” the company, according to Bloomberg.

- Terraform Labs agreed to pay $4.47 billion to resolve a civil lawsuit filed by the U.S. SEC following the firm’s 2022 collapse, reports Bloomberg, which wiped out $40 billion in investor assets and shook the cryptocurrency world.

Opportunities

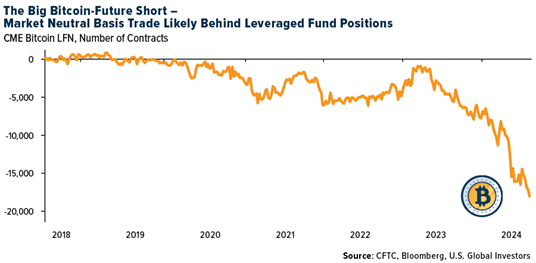

- Bitcoin futures are seeing a record high in net short interest among leveraged funds, yet don’t mistake that for an overwhelming sense of bearishness among hedge funds. It’s more likely due to an increasingly popular market-neutral strategy. What’s known as the basis trade, a strategy which seeks to profit between discrepancies in spot and futures markets, Bloomberg explains, likely accounts for much of the short interest of almost 18,000 CME Bitcoin futures contracts.

- U.S. President Joe Biden’s campaign is in discussions with cryptocurrency industry players about accepting crypto donations through Coinbase Commerce, which is a payment service that allows merchants to accept dozens of cryptocurrencies, writes Bloomberg.

- Venture capital firm Paradigm said it has raised $850 million for its third fund, reports Bloomberg, which will focus on early-stage crypto projects. Paradigm was previously an early investor and contributor for projects like crypto dex Uniswap and Optimism.

Threats

- The native token of Curve Finance, one of the cryptocurrency sector’s top decentralized exchanges, has tumbled to an all-time low. CRV slid as much as 38.2% on Thursday before paring some of the drop to trade at 26 cents, writes Bloomberg.

- Stablecoin issuer Paxos has cut its workforce by about 20%, says Bloomberg. The jobs cuts first reported by The Block come at a time when Paxos has more than $500 million on its balance sheet.

- Crypto exchange Gemini agreed to pay $50 million to resolve claims brought by New York’s AG accusing the company of defrauding investors. The settlement announced Friday will see Gemini return about $50 million of digital assets to investors who were locked out of their accounts when the program collapsed, writes Bloomberg.

Frank E. Holmes

Frank Holmes is CEO and chief investment officer of U.S. Global Investors, Inc., a boutique investment advisory firm based in San Antonio that manages domestic and offshore funds specializing in the natural resources and emerging markets sectors. The company’s no-load mutual funds include the Global Resources Fund (ticker PSPFX), the World Precious Minerals Fund (UNWPX) and the Gold Shares Fund (USERX).

Please consider carefully the fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk.

The S&P/TSX Global Gold Index is an international benchmark tracking the world’s leading gold companies with the intent to provide an investable representative index of publicly-traded international gold companies. The FTSE Gold Mines Index Series encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year, and that derive 75% or more of their revenue from mined gold.

Holdings as a percentage of net assets as of 6/30/07: Jiangxi Copper (China Region Opportunity Fund 1.74%); Silvercorp Metals Inc. (World Precious Minerals Fund 2.78%, Global Resources Fund 0.89%, China Region Opportunity Fund 2.42%); Gold Fields Ltd. (Gold Shares Fund 6.05%, World Precious Minerals Fund 2.58%, Global Resources Fund 0.39%); Sino Gold Mining Ltd. (Gold Shares Fund 1.03%, World Precious Minerals Fund 0.58%, China Region Opportunity Fund 0.27%); Anglogold Ashanti (0.0%); Dynasty Gold (0.0%).