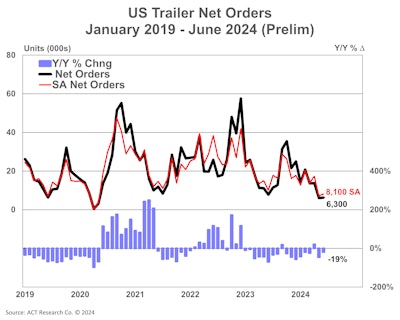

U.S. trailer orders in June remained below the previous year’s levels, according to ACT Research.

Preliminary net data indicated a 19% year-over-year decline, with orders dropping to 6,300 units. However, this total represented a slight increase compared to the previous month.

ACT Research

ACT Research

“This month’s data shows 26,000 trailers were ordered in Q2 2024, a 14% contraction compared to the same quarter in 2023. June’s net orders bring the year-to-date tally to 74,500, a reduction of 23,900 units, or 24% lower, compared to the first half of last year,” said Jennifer McNealy, director of commercial vehcile market research and publications at ACT Research.

McNealy noted that this year’s slower trailer orders are not unexpected given the high order rates of recent years. With weak fundamentals in the for-hire truck market and already full dealer inventories, it looks like trailer demand remains limited for some time.

FTR Intelligence said trailer orders continue to decline, with June numbers 17% down from May at 4,788 units, but up 44% from a June 2023 order level that was the lowest since at least 2023.

Orders were weaker than seasonal expectations and 71% below the monthly average order level over the last 12 months. Despite a year-over-year gain, cancellations accounted for over 30% gross orders, while the backlog-to-build ratio dropped to 5.6 months, its second-lowest level since 2020.

The U.S. trailer market is confronting major challenges, largely because of the stagnant truck freight and rate environment, said Dan Moyer, senior analyst of commercial vehicles at FTR.

Other near-term potential factors that could constrain the market’s growth and recovery include high dealer inventory levels, elevated pricing on inventoried units, and falling used trailer values, he said.

“It is important to remember that for orders, we are now in the weakest months of the annual cycle, minimally suggesting there is no catalyst for stronger orders before the fall and the OEMs’ opening of their 2025 order books,” McNealy said.

This sentiment was also echoed by FTR. Moyer said, “The opening of 2025 order books later this year along with the beginning of a potential truck freight recovery may improve market conditions. Meanwhile, OEMs will need to manage production cautiously.”

Although ACT expects to see fleets to start earning more money later this year, enhancing their ability to purchase equipment, McNealy noted that the impact on the trailer industry will probably be minimal. However, they anticipate their spending will prioritize new power units ahead of the EPA’s implementation of 2027 regulations, a trend that ACT believes has already begun.

[RELATED: Fleets should plan for an emissions pre-buy, experts say, and it may be too late for some]

McNealy added that industry sources suggest that the “pause button” is expected to stay engaged through the end of 2024. The largest segments of the industry continue to face pressure, with high cancellation rates as dealers and fleets adjust their needs. Moreover, external forces such as the upcoming US presidential election, low prices for used equipment, and high interest rates contribute to uncertainty in the near-and medium-term.

Truck pre-buy underway?

The freight market continues to be characterized by overcapacity, according to the latest release of the Freight Forecast: U.S. Rate and Volume OUTLOOK report, and with private fleets engaging in spot activity more than in past cycles, spot rates remain only slightly above the late-2023 lows.

“Class 8 tractor backlogs are thinning, but retail sales remain above replacement, more than two years after the spot market turned down. This fits the definition of a prebuy to a tee,” shared Tim Denoyer, ACT Research’s Vice President and Senior Analyst.

Through mid-July, Denoyer said rates have exceeded seasonal patterns by about four cents, mostly a temporary boost from Hurricane Beryl, which hit during a seasonally soft period for the truckload spot market. “Storms during stronger seasonality may have a larger impact on rates,” he added.

Freight market conditions are usually soft in early July, but DAT’s load/truck ratio rose meaningfully in the days following Beryl and have remained stronger than normal seasonality since. “Of course, the surge will likely be short-lived. But in our view, a seasonally adjusted DAT load/truck ratio at 7 signals a market closing in on balance, if still not quite there yet,” he added. “We need to see this measure at an 8 or 9 to push rates up much.”

The DAT load/truck ratio isn’t a scale of 1 to 10 and reached the mid-teens in 2017 and early 2018, and the high teens during 2021, peaking above 20.