Family offices face a unique predicament: while most investors struggle to find promising opportunities, these elite institutions are drowning in them. Every day, their inboxes overflow with pitches from venture capital firms and private equity houses, each claiming to offer the next billion-dollar thesis, ensuring maximum returns with minimal risk attached.

This flood of investment prospects, however, is both a blessing and a curse. Sorting through hundreds of proposals to identify truly exceptional opportunities requires significant time, expertise, and resources. The pressure to make smart decisions with generational wealth adds another layer of complexity to an already daunting task.

As we delve deeper into the world of family offices, we’ll explore how these institutions navigate the deluge of pitches, balance risk and reward, and strive to preserve and grow wealth for future generations. Enter Calista Direct Investors, a three-year-old firm, positioning itself as a disruptor in the heavily intermediated market of PE/VC investments, offering a unique value proposition to its exclusive clientele of family offices.

The Family Office Edge: Calista’s Innovative Framework for PE/VC Success

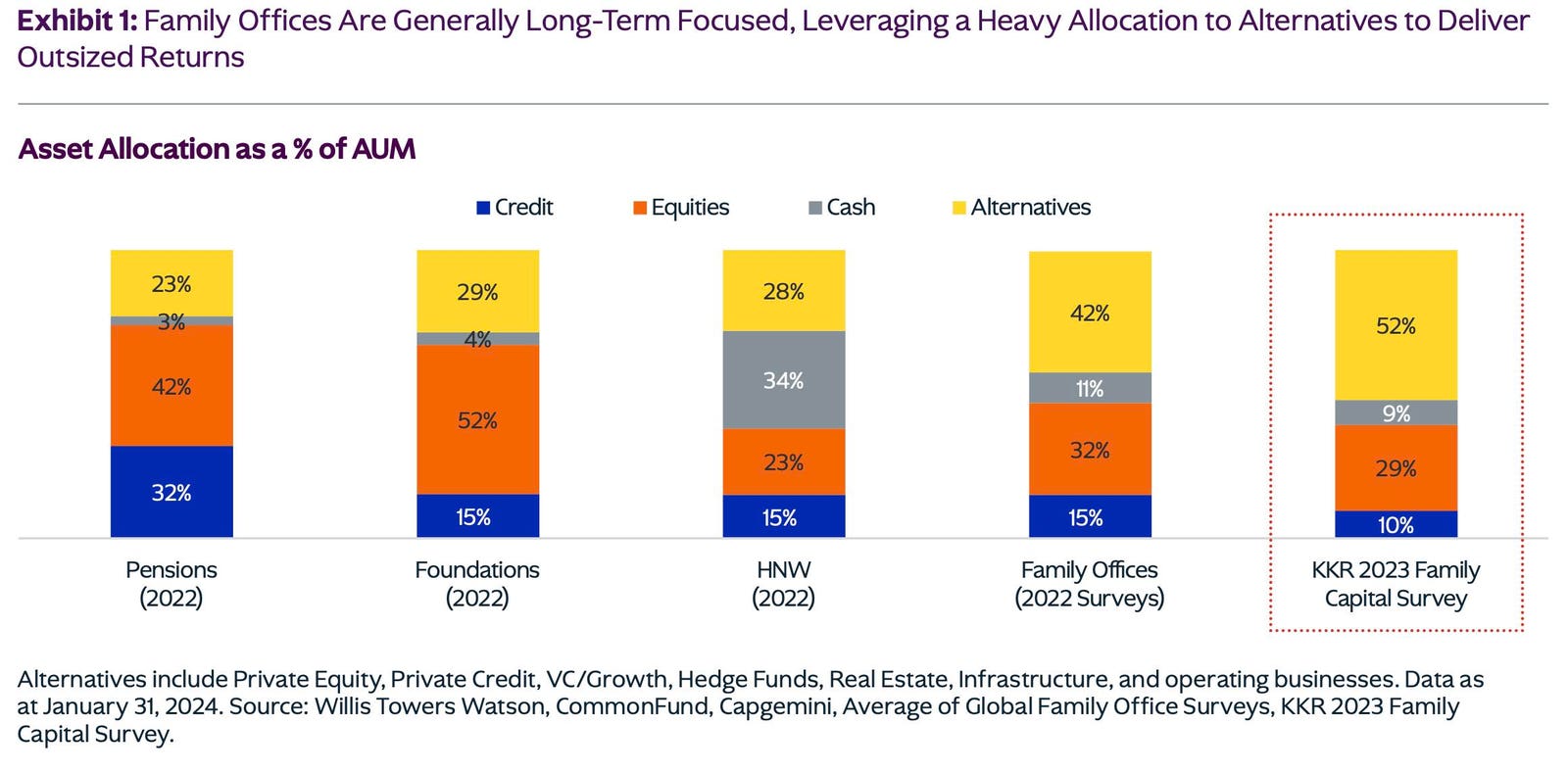

Family offices have become increasingly significant players in the alternative investment space. According to a 2023 KKR Family Capital Survey, family offices now allocate 52% of their assets to alternatives, surpassing traditional institutional investors. This shift underscores the growing sophistication and risk appetite of family offices in the PE/VC arena.

Rajaa Mekouar, Founder and CEO of Calista Direct Investors, offers a unique perspective on this trend: “Calista is a disrupter in a heavily intermediated market. We sit alongside the families, as an extension of their investment team, working as their partner. As such, our revenues exclusively come from our investors, and we go further, as we co-invest with them when possible, knowing the investment decision rests with them exclusively.” This approach marks a significant departure from traditional investment models, emphasising alignment and transparency with family office clients.

This approach has resonated with family offices seeking more direct involvement and alignment in their investments. Calista’s network of over 300 families and entrepreneurs provides a rich ecosystem for sourcing deals and sharing insights. In 2023 alone, the firm reviewed over 500 direct investment opportunities and 300 fund opportunities, showcasing the depth of deal flow available to family offices.

The Observatoire: A Unique Lens into PE/VC Trends

At the heart of Calista’s offering is the “Observatoire“, a platform that serves as a lens through which the firm constantly discerns key trends in PE/VC from the perspective of family offices and entrepreneurs. This unique vantage point allows Calista to monitor how investment profiles evolve over time and showcase top trends, sectors, and regions that resonate with their family office clients. As Mekouar aptly puts it, “Observatoire is the lens through which we constantly observe key trends in PE/VC from the perspective of Family Offices and entrepreneurs. To do so, besides constantly exchanging with our families, we track the market with our experts and practitioners who provide more technical viewpoints. Our annual Single Family Office survey is another dimension that allows us to convey all findings on a more statistical basis.” This perspective, combined with professional execution and a focus on long-term value creation, is setting the stage for a new era in family office investing – one that promises to shape the future of private equity and venture capital in profound ways.

The Observatoire’s annual observation session brings together Calista’s network of families to discuss emerging trends. This is supplemented by insights from experts and practitioners who provide technical viewpoints, ensuring a comprehensive understanding of the market dynamics.

Calista’s commitment to understanding the needs and preferences of family offices is perhaps best summarised by its annual Single Family Office survey. Only Single Family Offices were included in this study and the survey received a total of 37 responses. The majority of families surveyed have a total Assets Under Management (AUM) of more than 100 million Euros. All analyses were calculated using averages or medians, and the results have been anonymized – respecting the need for privacy of all participants.

The survey also revealed that PE/VC remains an asset class of strong conviction for Single Family Offices, despite various challenges. Mekouar notes several emerging themes that are gaining traction among their family office clients:

- DeepTech and SpaceTech

- Healthcare

- B2B Services

- Small Cap Leveraged Buyouts (LBOs)

- Secondaries

Single Family Offices Active in PE/VC, source: Source: … [+]

Unveiling Key Insights: The Annual Family Survey

Calista’s approach is designed to address the specific challenges faced by Single Family Offices and the report has identified three primary hurdles:

- Access to professional talent for successful investment execution, for example 51% of the surveyed offices do not have a formal investment committee. While Family Offices show considerable competence in PEVC investing a significant portion of these families do not possess the comprehensive infrastructure traditionally associated with making fully informed investment decisions.

- Sourcing quality investment opportunities

- Time constraints for conducting professional due diligence

Calista’s selection process, source: https://www.calista-directinvestors.eu/what-we-do

To tackle these issues, Calista offers a team of talented analysts, a professional investment process, and a high-quality network for sourcing opportunities.

Mekouar shares some key findings from their annual Family Survey: “Our geographical focus so far has been Europe, where most of our families sit. This first Calista Family Office survey highlights both the profiles and the investment stance of our investors. Amongst them: The key preference for Healthcare as an investment sector; Talent shortages as a key bottleneck when it comes to investing; Relative optimism in terms of future PE/VC performance expectations.”

This first edition of the survey, focused primarily on Europe, revealed several key findings:

- Industrial root and lean operations: The majority of the families in the Calista network have entrepreneurial or industrial roots, and therefore it is no surprise that a significant number of these family offices still own a family business. The surveyed family offices typically operate lean models with only 32% of families employing more than 10 employees.

- Despite challenges, 54% of family offices maintain optimism regarding future PE/VC performance expectations in the next 12 months and 51% believe that the macro situation will be the main factor in improving PE performance.

- Given the above mentioned lean nature of family offices, on occasion they lack the necessary resources to fully address their sourcing needs. This can also then cause a knock-on effect in their ability to source and perform due-diligence on deals.

Key Takeaways from the Annual Survey, Source: … [+]

A Disruptive Model: “We work like a GP but think like a family”

What sets Calista apart from traditional PE/VC investment models is its position as an extension of family office investment teams. This need for additional assistance is exacerbated further when taken into account 51% of the surveyed offices do not have a formal investment committee. While family offices show considerable competence in PE and VC investing, a significant portion of these families do not possess the comprehensive infrastructure traditionally associated with making fully informed investment decisions. To tackle these issues, Calista has developed a comprehensive solution. “We provide a team of talented analysts, a professional investment process and a top-quality network to source opportunities,” Mekouar explains. Their model ensures that the firm generates revenue exclusively from its investors and, when possible, co-invests alongside them. This approach ensures total alignment and fosters extreme transparency.

Calista’s model disrupts the traditional intermediary-heavy structure of PE/VC investments. By sitting alongside families as a partner, it cultivates a relationship based on trust and shared interests, with the final investment decisions resting solely with the family offices.

Early Success and Emerging Winners

Despite being only three years old, Calista is already seeing emerging winners from its conviction themes. Particularly promising sectors include DeepTech/SpaceTech, Healthcare, and B2B Services. In terms of investment themes, Small Cap LBOs and Secondaries have shown potential.

Key opportunities in secondaries, source: https://www.calista-directinvestors.eu/observatoire

While it’s too early to declare definitive successes, some of the best Calista family positions have been marked up between 1.2-2x since entry. Importantly, none of the participations has suffered a write-off since 2021, indicating positive performance across the portfolio.

Integrating Sustainability and Impact

Recognizing the growing importance of sustainability and impact in investment strategies, Calista has partnered with Fondazione AIS, a trailblazer in impact measurement for PE/VC investments. This collaboration involves the development of an online tool called “CIM,” which will enable family offices to proactively address ESG aspects of their PE/VC investments.

This partnership underscores Calista’s commitment to supporting families in their role as stewards of long-term capital that cares about its broader ecosystem.

Balancing Long-Term Perspective with Dynamic Investments

One of the unique aspects of working with family offices is their long-term investment horizon. Calista leverages this aspect as an advantage when building portfolios, using it as a stable base for a conviction-driven investment approach.

However, the firm recognizes that long-term doesn’t mean rigid. Drawing parallels to the entrepreneurial origins of many family fortunes, Calista emphasises the need for permanent adaptation to change. Their investment philosophy balances a fixed end goal (conviction/strategy) with a flexible process (pragmatism/tactics) to navigate the journey.

This approach is reflected in Calista’s focus on cash multiples rather than IRR when evaluating return generation, aligning with the long-term perspective of family offices.

Calista Direct Investors team photo

Royal Patronage and Exclusive Events

Adding to its unique positioning, Calista has secured HRH Prince Felix of Luxembourg as a patron for future Observatoire events. Prince Felix, a board member since Calista’s inception, brings a background in entrepreneurship and tech investing, along with values of ethics, family stewardship, and sustainability that align perfectly with Calista’s mission.

Future Observatoire editions will be hosted at Prince Felix’s wine estate in Provence, maintaining the event’s exclusive, invitation-only status for Calista families.

Looking Ahead: Trends Shaping Family Office Investments

As Calista looks to the future, several trends are expected to significantly impact family office investments in PE/VC over the next 3-5 years:

- The emergence of family capital as GP stakes in emerging managers

- A consistent rise in direct investments within family allocations

- The development of a proper taxonomy in ESG/sustainability, driven by pioneering efforts from a group of families

- Family offices becoming the employer of choice for top business school graduates, potentially triggering a war for talent

Calista, however, does not aim to compete with family offices for talent. Instead, it offers an alternative hybrid model that optimizes the cost-benefit matrix for families seeking to balance in-house talent with externalized efforts.

Leveraging a Powerful Network

With a network of over 300 investors and access to 300+ annually sourced deals, Calista aims to be the bellwether for families in PE/VC investments and as Mekouar expalains, the numbers keep growing” On average, annually, we sourced 874 and 412 directs and funds respectively, which comes to 2/3 directs and 1/3 funds”. The firm provides an unbiased perspective on key trends, identifying the most attractive investments on a risk-adjusted return basis.

This capability is further enhanced by Calista’s close collaboration with purpose-driven family capital. As described by Serge de Ganay, Calista’s founding Chairman and co-shareholder, the firm is in the business of “co-production” with its families. For family offices, effective governance is crucial for sustainable wealth creation. Serge de Ganay, drawing from his experience with the 8th generation Bemberg Group, emphasizes the importance of putting business first: “When you use the phrase family business, the keyword is ‘business’, not family. Think about governance as the instrument that is best able to support the business; if the business is doing well, the family will be too.”This powerful strategy creates long-term value and a win-win equation for all partners involved.

Conclusion: A New Era for Family Office PE/VC Investments

As the PE/VC landscape continues to evolve, Calista’s innovative approach offers a compelling solution for family offices seeking to navigate this complex asset class. By addressing key challenges, fostering transparency and alignment, and leveraging a unique network, Calista is well-positioned to lead the way in reshaping how family offices approach PE/VC investments.

With its focus on long-term value creation, integration of sustainability concerns, and commitment to serving as a true partner to family offices, Calista represents a new paradigm in the world of private equity and venture capital investments. As the firm continues to grow and evolve, it will be fascinating to watch how its approach influences the broader PE/VC ecosystem and potentially reshapes the role of family offices in this dynamic market.