Peak season for container shipping arrived a month earlier this year, moving from July to June, due to factors such as restocking, backlog and the advance shipment of Chinese electric vehicles (EVs).

The extension of U.S. Section 301 tariffs and increased tariffs on certain Chinese imports, particularly solar panels and EVs, along with the EU’s imposition of a 38.1 percent tax on Chinese EVs starting in July, have brought about this earlier peak season, according to the Asia Pacific Freight Report from Dimerco.

“As a result of recent events, carriers have intensified the frequency of their general rate increases (GRIs) on a fortnightly basis and have imposed tripled peak season surcharges compared to last year in May and June,” says Alvin Fuh, Special Assistant to the CEO, Dimerco Express Group. “Some carriers are offering premium options like Diamond Tier, SPGO and Premium Class for clients needing priority loading without roll-over risks. Comparing the prevailing Freight All Kinds (FAK) floating long-haul rates for Europe Westbound (EUWB) and Trans-Pacific Eastbound (TPEB) with the lowest rates in March, there has been an increase of 130 percent and 100 percent, respectively. Another rate hike, reminiscent of pandemic levels, seems imminent.”

Disruptions galore

The Red Sea crisis is unveiling its disruptive impact on the global supply chain, comparable to challenges faced during the pandemic years, the update added. “The rerouting of ships from the Suez Canal to the Cape of Good Hope, adding 14 to 20 days to transit times, has shifted carrier capacity from expected oversupply to a deficit. This has triggered a chain reaction of port congestion, equipment shortages and booking delays in a vicious cycle. With supply and demand balance disrupted and leaning towards supply, the exorbitant ocean freight costs seen during the pandemic may resurface soon.

“Another potential threat to the supply chain is the interruption of the master contract renewal between International Longshoremen’s Association (ILA) and United States Maritime Alliance (USMX), which is set to expire on September 30, 2024. ILA halted negotiations with USMX to protest Maersk’s attempt to utilise an auto gate system, which could automatically process trucks without ILA labour at the Port of Mobile, Alabama and some other APM terminals on the USEC. While it’s still too early to predict the outcome of the negotiations, we expect that ILA members will raise their voices and stakes if more carriers follow Maersk’s example to boost their annual returns by the end of the accounting year in 2024.”

Carriers announced the cancellation of 46 sailings out of their East-West head haul trades from weeks 25 to 29, representing a seven percent cancellation rate out of a total of 661 sailings, the update added. “Conversely, carriers like MSC, HL and CMA CGM are deploying new standalone loops, shuttling among Asia, Northern Europe, and back to Asia starting in June to accommodate more premium freight bookings during peak season. This will inject an additional six percent capacity into the Asia/Europe lanes by June/July.”

Country report

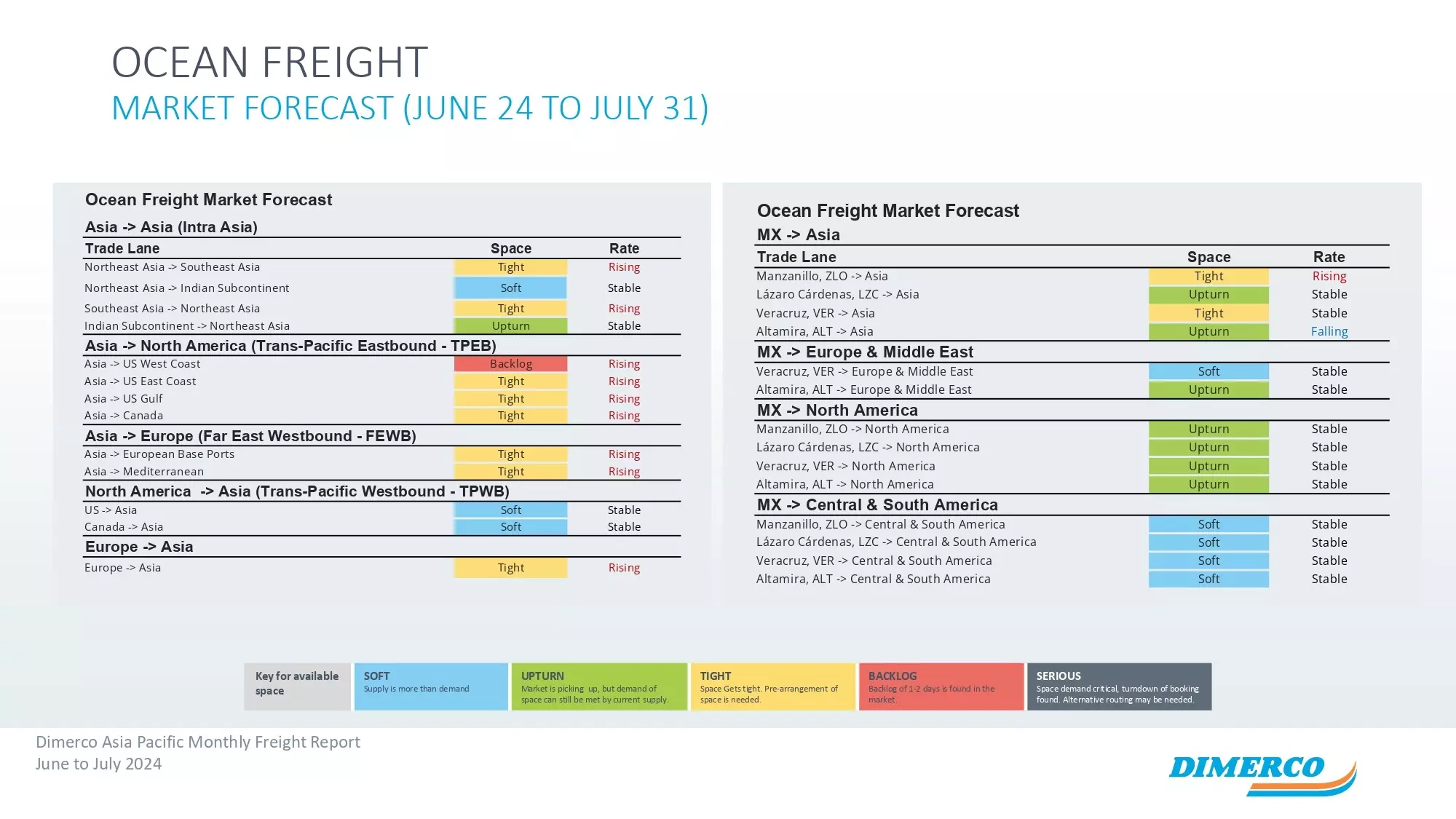

The Transpacific Eastbound route to the U.S. remains highly active and short on capacity. Peak season surcharges have arrived earlier than usual with more expected in July. Vessels are fully booked, and port congestion in Asia is intensifying the situation. Additionally, high vessel charter rates indicate that no available capacity is being left unused, the update added.

Following the port congestion situation in May, the issue continued in June with a slight improvement in Singapore. “Capacity is expected to be tight due to port congestion at the transshipment port, a result of the Red Sea situation. This congestion will increase freight rates and reduce space availability with July expected to be particularly challenging. Although efforts are underway to expand berthing locations and container yard space, these adjustments will take time. Freight rates are likely to continue rising through August with space out of Singapore remaining tight. It is advised to plan ahead and anticipate higher freight rates and limited space for export shipments in the coming months.”

Ocean freight rates have surged from Thailand since June, with some carriers revising their rates even before their scheduled expiration. For intra-Asia routes, ports in China and Singapore remain particularly congested. For the U.S. lane, schedules are being checked on a case-by-case basis. Similarly, for intra-Asia and Europe routes, space must be reserved at least 2-3 weeks in advance, the update added.

“The North and Westport in Malaysia are experiencing heavy congestion, leading to delays of at least five days. Numerous vessels have arrived but are unable to berth. It is advised that bookings for outgoing shipments need to be made at least two weeks in advance.”

Rates have risen and space has become tight from South China, and iIt is advisable to book two-three weeks in advance on the U.S. lane.