Trucking news and briefs for Thursday, Aug. 1, 2024:

Broker survey shows signs of optimism in freight market

A semi-annual survey of freight brokers from Bloomberg Intelligence and Truckstop shows brokers are hopeful that demand could pick up in the latter half of the year.

“Though freight brokers continued to face challenging demand and rates in the first half of the year, there are some signs that the worst may be over,” said Lee Klaskow, senior freight transportation and logistics analyst at Bloomberg Intelligence. “We believe a return to seasonal demand, higher import levels and inventory restocking will help drive a recovery later this year.”

The survey was completed by 113 freight forwarders, third-party logistics providers, broker agents, and asset- and non-asset-based brokers. Most of the respondents — 70% — have 50 or fewer employees. Non-asset-based brokers made up the biggest group, followed by broker agents and 3PL providers.

[Related: ‘Fraud apocalypse’: Brokers circling the wagons, shutting carriers out]

The survey found 49% of brokers expect near-term volume growth in the next six-nine months, despite demand challenges. Around 31% expected loads to stay flat while 20% anticipated a decline.

More than two-thirds of brokers believe rates have hit bottom and expect them to stay flat or increase over the next three-six months. Truckstop’s Market Demand Index is up 24% on average from the second quarter of last year.

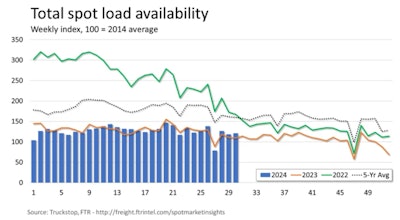

As shown on this graph from the Truckstop/FTR Transportation Intelligence weekly snapshot, volumes this year have generally followed patterns seen during 2023 on the spot market, albeit at lower rates than 2023 until recently. Yet total volume was nearly 11% above the same 2023 week, possibly underscoring brokers’ expectation of better volume ahead. 2024 measures so far, however, are still 24% below the five-year average for the week. Check out the FTR/Truckstop weekly “Spot market insights” report at this link for more.

As shown on this graph from the Truckstop/FTR Transportation Intelligence weekly snapshot, volumes this year have generally followed patterns seen during 2023 on the spot market, albeit at lower rates than 2023 until recently. Yet total volume was nearly 11% above the same 2023 week, possibly underscoring brokers’ expectation of better volume ahead. 2024 measures so far, however, are still 24% below the five-year average for the week. Check out the FTR/Truckstop weekly “Spot market insights” report at this link for more.

How do owner-operators and small fleets survive and thrive in tough economic times? Find out in this webinar.

Join us for a live webinar Aug. 22 at 1 p.m. CT and hear from owner-operators and small fleets as we discuss how they prepared during the good times to weather the storms.

Around 44% of survey respondents noted lower gross margins in the first half of 2024 compared to the same time frame in 2023. That is 13 percentage points worse than what brokers indicated in 2023. Around a third of surveyed brokers expect margins to deteriorate over the next six months.

“Despite the improved outlook over the past six months, brokers remain skeptical about their ability to increase gross margins,” said Kendra Tucker, CEO of Truckstop.

[Related: How to build business for trucking’s down cycles: Live this month]

New Mexico begins CDL downgrades for drug/alcohol violations in the Clearinghouse

New Mexico is among the first states to implement automatic CDL downgrades for Federal Motor Carrier Safety Administration Drug and Alcohol Clearinghouse violations.

The New Mexico Motor Vehicle Division (MVD) announced July 29 that it is now checking the Clearinghouse for potential drug and alcohol violations before taking action on CDLs.

All states, no later than November 2024, are required to query the Clearinghouse before issuing, renewing, transferring or upgrading a CDL. Previously, only employers were required to do so.

Drivers who fail or refuse to submit to a drug or alcohol test will now have their CDLs downgraded until they complete the return-to-duty process.

“Drivers of commercial vehicles are critical to the nation’s economy, and it is equally critical that they operate in a safe manner,” said New Mexico MVD Director Htet Gonzales. “This is one more tool to make sure that is happening,”

Employers must have drivers submit to drug tests before hiring, after accidents and randomly throughout the year. Positive test results or refusals to submit to testing must be reported to the Clearinghouse.

When a violation is reported to the clearinghouse, it automatically notifies their state of domicile that the driver has a “prohibited” status, and the license is automatically downgraded to a Class D, non-commercial license. The driver is notified of the downgrade by mail.

Similarly, if the driver completes the federal return-to-duty process after a violation and it is reported to the Clearinghouse, the system generates a notice to the driver’s license agency, and the CDL is automatically reinstated.

New Mexico’s MVD said it was the third state in the nation to integrate with the clearinghouse, after Utah and Texas and just before Rhode Island.

[Related: FMCSA tells states to ban drivers with drug, alcohol strikes]

Senate transpo committee approves bill to streamline TSA credentialing

A bill in the U.S. Senate that would make it easier for truck drivers to obtain both a hazmat endorsement and a Transportation Worker Identification Credential (TWIC) was approved Wednesday by the Senate Committee on Commerce, Science, and Transportation.

The Transportation Security Screening Modernization Act would allow workers to apply existing valid background checks to multiple TSA-managed credentialing programs, such as the TWIC and the hazmat endorsement, and using just one background check for both programs.

Harmonizing these programs and eliminating duplicative screenings, the bill would codify formal recommendations made by the Government Accountability Office dating back to 2007. Those recommendations have since been reaffirmed in a comprehensive security assessment conducted in 2020 by the Homeland Security Operational Analysis Center.

The bill does not affect how background checks are conducted, so applicants would still go through the same level of review as they currently do.

A companion bill was previously introduced in the House by Representatives by Reps. Garret Graves (R-Louisiana), Adam Smith (D-Washington), Mark Green (R-Tennessee), Michael Guest (R-Mississippi), Salud Carbajal (D-California), and Dina Titus (D-Nevada) and is currently pending before the House Committee on Homeland Security.

Last day to sound off on towing fee transparency

August 1 is the last day for drivers, carriers and all others to comment on the Federal Register docket on towing industry practices, specifically the the disclosure of towing fees to the commercial motor vehicle owners and whether the owner is made aware of costs and fees prior to the tow.

The comment period was extended once already to allow more time after a notice was originally published May 31 announcing the Federal Motor Carrier Safety Administration’s plans for a public meeting regarding towing industry practices and fees, which was held June 21 and was dominated by tow-truck industry participants. As reported, the meeting featured discussion of what is or isn’t predatory when it comes to towing fees, some of it from a few trucking interests, too.

The agency said then it “believes it is in the public interest to allow additional time for interested parties to submit written comments to the docket.”

Comments can be filed here through the end of today, Aug. 1.

[Related: Towing industry dominates FMCSA public discussion of predatory billing and practice]