Global demand for ocean freight container shipping hit an all-time record in May amid soaring spot rates and severe port congestion, according to data released by Xeneta and Container Trades Statistics.

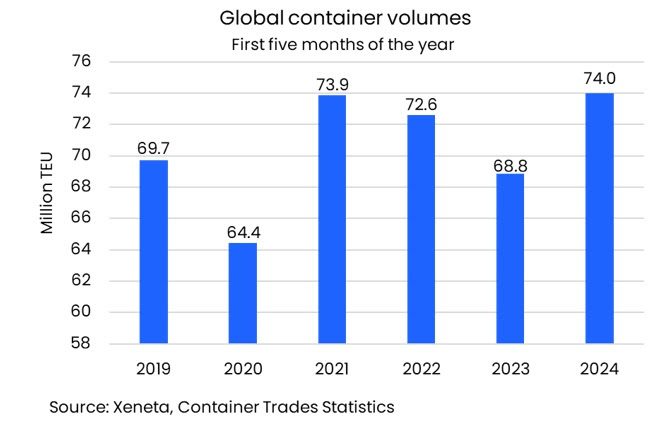

In May, 15.94 million TEU were transported by ocean, surpassing the previous record of 15.72 million TEU from May 2021. Year-to-date volumes are just under 74 million TEU, a 7.5% increase compared to the first five months of 2023.

“More containerized goods are being shipped by ocean than ever before at a time when available capacity is impacted by diversions around Africa due to conflict in the Red Sea and severe port congestion in Asia and Europe,” said Emily Stausbøll, Xeneta Senior Shipping Analyst. “This is a perfect storm of pressure on ocean supply chains which has resulted in the chaos of recent months.”

The surge in demand is largely driven by volumes from the Far East, with China exporting an all-time high of 6.2 million TEU in May, accounting for 39% of global container trade. Average spot rates from the Far East to the US West Coast reached USD 7840 per FEU on 9 July, a 200% increase since 30 April. Rates to the US East Coast rose by 130% to USD 9550 per FEU, while rates to North Europe and the Mediterranean increased by 148% and 88%, respectively, to USD 8030 and USD 7830 per FEU.

The surge in global container trade demand is driven by record exports from China, which reached 6.2 million TEU in May. The surge has driven significant increases in spot rates: 200% to the US West Coast, 130% to the US East Coast, and notable rises to North Europe and the Mediterranean.

Stausbøll highlighted concerns among shippers, noting, “Given we are already seeing record-breaking volumes in May ahead of the traditional peak season in Q3, you can understand why shippers are so concerned. The spot market is still climbing, the conflict in the Red Sea shows no signs of ending, and the port congestion we are seeing in Asia and Europe will take time to de-pressurise.”

The record levels of demand, coupled with longer sailing distances around the Cape of Good Hope, have led to a 17.9% increase in TEU-miles globally in 2024 compared to the same period in 2023. This increase is primarily driven by Red Sea diversions and longer sailing routes. Had carriers continued to use the Suez Canal, TEU-miles would have increased by a lesser 8.6%.

Global TEU-miles so far this year have increased by 17.9% compared to 2023 due to higher demand and longer sailing routes around the Cape of Good Hope, primarily driven by Red Sea diversions. However, using the Suez Canal would have resulted in a smaller increase of 8.6%, according to Xeneta.

“Earlier this year we saw increasing ocean freight shipping spot rates and wondered if there really was a capacity crunch or whether it was a case of the market panicking unnecessarily following the escalation of conflict in the Red Sea. We can now clearly see in the data the squeeze on capacity was very real. It also demonstrates how much oversupply of capacity there would have been in the market in 2024 had the Red Sea conflict not occurred,” Stausbøll concluded.

Unlock Exclusive Insights Today!

Join the gCaptain Club for curated content, insider opinions, and vibrant community discussions.