Trucking news and briefs for Thursday, Dec. 5, 2024:

Winter weather prompts truck restrictions

A winter storm expected to bring strong winds and snow from Southern Canada into the Upper Midwest and Northeast has prompted highway officials in Pennsylvania to issue restrictions on truck traffic.

The storm is expected to bring snow squalls and near-blizzard conditions to areas from Wisconsin to Maine, and as far south as West Virginia and Maryland.

Pennsylvania officials have issued a 45-mph speed restriction and ordered all commercial vehicles to stay in the right lane on the following routes:

- I-79 from I-80 to PA-5

- I-80 from Ohio Line to Exit 212

- I-86

- I-90

- I-99 from Exit 52 to I-80

Additionally, a Tier 2 Vehicle Restriction is in place along I-80 from the Ohio State Line to Exit 212.

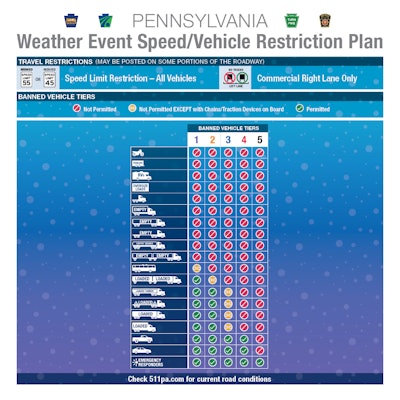

A Tier 3 restriction, requiring chains or other traction control on-board for most commercial trucks with some exceptions (see graphic below), is in place along I-79 from I-80 to Exit 183; I-86; and I-90.

Pennsylvania’s winter vehicle restriction plan graphic shows which vehicles are barred under certain tiers.PennDOT

Pennsylvania’s winter vehicle restriction plan graphic shows which vehicles are barred under certain tiers.PennDOT

For trucks, Tier 2 restrictions prohibit tractors without trailers; tractors towing unloaded or lightly loaded enclosed trailers, open trailers, or tank trailers; tractors towing unloaded or lightly loaded tandem trailers; enclosed unloaded or lightly loaded cargo delivery trucks/box trucks that meet the definition of a CMV (all Tier 1 restrictions); plus, those towing loaded tandem trailers without chains or Alternate Traction Devices (ATDs).

The Tier 3 restriction includes all of the Tier 1 and 2 restrictions, and prohibits trucks towing loaded tandem trailers regardless of the availability of chains or ATDs, and all other commercial vehicles except for those carrying full coverage tire chains for at least two drive wheels, or those with approved ATDs.

[Related: Latest Gear Guide offers winter prep tips, truckers’ Christmas list, more]

False logs result in jail time for trucking company co-owner

The co-owner of a now-defunct Massachusetts-based trucking company was sentenced Nov. 21 for charges related to a fatal crash that killed seven motorcyclists.

Dunyadar Gasanov — who owned Westfield Transport, Inc., a for-hire interstate motor carrier that transported vehicles — was sentenced to two months in prison, a year of supervised release, and a $300 special assessment.

According to the Department of Transportation Office of Inspector General, from May 3, 2019, to June 23, 2019, Gasanov falsified logs to evade federal regulations. Gasanov instructed at least one Westfield Transport employee to falsify records to hide the fact the driver had exceeded the number of permissible driving hours.

Gasanov then made false statements to federal safety inspectors regarding the manipulation of recording devices that track drivers’ on and off duty hours in order to evade regulations.

[Related: ‘Man v. machine’ comes to the roadside: Mitigating rising ‘false log’ risk]

Gasanov also falsely stated to safety inspectors that he met the driver involved in a fatal crash that killed seven motorcyclists on the day he hired the driver. Gasanov had in fact known the driver for years prior and was aware that the driver had been previously charged with operating a vehicle under the influence of alcohol.

In the crash in question, the driver of a 2016 Dodge 2500 with a car-haul trailer used in hotshot operations collided with a group of motorcyclists after crossing a double yellow line into their lane. A report issued in December 2020 by the National Transportation Safety Board said the driver, 23-year-old Volodymyr Zhukovzkyy, was operating the pickup towing a car-hauling trailer. The NTSB report indicated he was under the influence of “multiple drugs” and alcohol at the time and had a history of impaired driving. NTSB concluded Zhukovzkyy should have had his CDL revoked by the state of Massachusetts before the crash occurred.

Zhukovzkyy was running a paper log at the time of the crash, but the company broadly employed KeepTruckin’s e-log app in AOBRD form. The crash occurred prior to the December 2019 date by which all drivers were required to transition from AOBRD- to ELD-spec devices. NTSB said the company manipulated KeepTruckin’s hardware and software so as to falsify their logs.

[Related: As small-fleet owners face charges, confusion ensnares popular ELD]

Trucking, construction company owners, employee charged with COVID loan fraud

A federal grand jury returned a 13-count indictment charging three Illinois men for engaging in a Paycheck Protection Program (PPP) loan fraud scheme in East St. Louis, Illinois.

Dana C. Howard of O’Fallon, Richard Scott Myers of Edwardsville, and Glenn Sunnquist of Swansea are each facing one charge of conspiracy to commit wire fraud and two counts of wire fraud. Howard is also facing charges for making a false statement, two counts of bankruptcy fraud and three counts of willful failure to pay taxes. The grand jury also charged Myers with one count of monetary transaction in funds derived from a specified unlawful activity and three counts of bankruptcy fraud.

In response to financial hardships during the COVID-19 pandemic, the U.S. Small Business Administration utilized the PPP to offer relief and forgivable loans to struggling businesses. Under PPP, business owners could apply for loans to offset operational costs for payroll, employee benefits, facility expenses and other bills.

According to an Internal Revenue Service press release, Howard and Myers were co-owners of construction company Zoie, LLC, and freight company Zade Trucking, both in East St. Louis. Sunnquist was employed as a bookkeeper for both businesses.

In April 2020, Howard and Myers applied for and received a PPP loan for $1,426,500 and asserted more than $1.3 million of the funds would be used to keep Zoie operational and employees paid during the pandemic. Howard and Myers are accused of using the large loan for their personal use and to the benefit of another business they owned and not the intended use of the funds.

The indictment alleges that in 2020, both Meyers and Howard filed for bankruptcy indicating they had little to no PPP loan funds left when in fact combined they had $450,000 available to them through cashier’s checks. Howard and Myers are also alleged to have applied for a second PPP loan for more than $1.4 million in January 2021, falsely indicating they were not involved in any bankruptcy proceedings and thereafter also sought forgiveness of the first loan.

Sunnquist is accused of falsifying Zoie’s expense records and manipulating old invoices to support the loan’s forgiveness application. In September 2022, SBA denied forgiveness of the loan.

[Related: Struggling small fleets stung by cash advance lenders]

Two plead guilty for defrauding factoring companies, COVID assistance fraud

On November 14, 2024, Yeniseis and Alien Saavedra pleaded guilty in U.S. District Court for the Western District of Kentucky to conspiracy to commit wire fraud and disaster fraud. Yeniseis Saavedra also pleaded guilty to making a false statement to the Federal Motor Carrier Safety Administration and aggravated identity theft.

[Related: Fraud in supply chain not just a ‘broker problem’]

According to the DOT OIG, the co-conspirators defrauded factoring companies by submitting false bills of lading and other documentation. Additionally, Alien received low wage assistance payments authorized by a Presidential Memorandum resulting from the COVID-19 pandemic, but Yeniseis and Alien Saavedra failed to report Alien’s earned wages.

In addition, Yeniseis submitted false information on an FMCSA application on behalf of another without their knowledge. Yeniseis also filed and received COVID low wage assistance payments with the Kentucky Office of Unemployment on behalf of another person; however, that person was not aware of and never received those benefits.

Charges were filed against the pair in February 2023.

[Related: Kentucky duo face prison in freight fraud indictments]