Trucking news and briefs for Friday, July 19, 2024:

Bridge strike leads to shutdown for Canadian fleet

The Canadian province of British Columbia took further action on the B.C. bridge strike problem on Tuesday, shutting a fleet down and issuing a fine for a first offense in a crackdown on overheight trucks.

S.G.D. Transport Ltd., a seven-truck fleet headquartered in the province, had all its units pulled out of service on Tuesday after one hit the CP Rail Overpass on Highway 1 in Langley, British Columbia. S.G.D. will remain suspended pending a further investigation.

Authorities issued a ticket of $575 to the driver of the vehicle involved in the July 16 incident — for operating an overheight vehicle without a permit, the Ministry of Transportation and Infrastructure said.

This represents the 19th bridge strike in the province in 2024 alone, according to a tracker on the Ministry’s website.

The problem has grown so bad that B.C. imposed penalties of up to $100,000 and even 18 months of jail time for offending drivers.

“We are taking the strongest action possible to keep our roads safe and to keep people, goods and services moving,” said Rob Fleming, announcing the penalties in March. “This also sends a message to commercial truck drivers that they are responsible for the safe transportation of goods and services on our roads, and a lax attitude toward safety will not be tolerated.”

The fines start at around $500 and get worse, potentially a reaction to Chohan Freight Forwarders, a 65-truck fleet in B.C. with numerous bridge strikes that got shut down in January.

With a “progressive enforcement framework, suspensions cost the carrier far more in business than the amount of the ticket,” the ministry said. “Depending on the circumstances, including previous infrastructure crashes, and at [Commercial Vehicle Safety and Enforcement’s] discretion, B.C. carriers involved in repeat incidents may face suspensions pending investigations that take days, suspensions pending audits that take weeks, and potentially, ultimately cancellation of their carrier safety certificate, ceasing their on-road operations.”

Finally, the ministry concluded, “B.C. carriers must cease operations and park vehicles immediately upon suspension of their safety certificate.”

[Related: $100,000 fines, jail time proposed as carriers keep hitting bridges in British Columbia]

Volvo debuts new CARB-compliant D13 engine

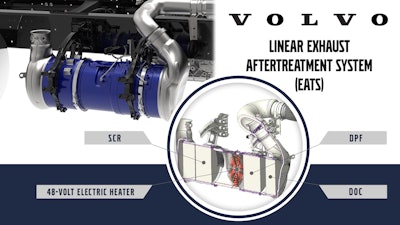

Volvo Trucks’ CARB ’24-compliant engine features an advanced emission control system integrated with a fully serviceable linear exhaust aftertreatment system (EATS).Volvo Trucks

Volvo Trucks’ CARB ’24-compliant engine features an advanced emission control system integrated with a fully serviceable linear exhaust aftertreatment system (EATS).Volvo Trucks

Volvo on Thursday added a third D13 engine model to its product line, the newest one compliant with the California Air Resources Board (CARB) 2024 Omnibus regulation requirements for low nitrogen oxide (NOx) and particulate matter (PM) emissions standards.

The CARB ’24-compliant engine joins the D13 and the Turbo Compounding D13 in the order book, and is now available for spec on VNR and legacy VNL trucks (not the all-new VNL) with a power rating of 455 hp and 1650 lb.-ft. of torque.

It meets CARB Omnibus regulation mandates that require a 75% reduction in NOx emissions and a 50% reduction in particulate matter (PM) from heavy-duty on-road engines for engine model years 2024 through 2026 compared to existing U.S. Environmental Protection Agency (EPA) standards.

[Related: EPA 2027 diesel emissions regs: Class 8 truck price hikes in the offing]

As a result of the Clean Truck Partnership, an agreement completed last year between CARB and truck manufacturers, there will be alignment in all 50 states with federal standards for NOx emissions beginning in 2027.

Volvo’s CARB ’24-compliant, 13-liter engine features a variable geometry turbo (VGT) and an advanced emission control system integrated with a fully serviceable linear exhaust aftertreatment system (EATS). Each component, including the Diesel Oxidation Catalyst (DOC), Diesel Particulate Filter (DPF), Aftertreatment Heater, and Selective Catalytic Reduction (SCR), is designed for individual servicing or replacement, an approach that minimizes waste and maximizes operational lifespan.

A 48-volt alternator has been incorporated onto the engine to supply power to a 48-volt battery that powers the heater during startup and low-load situations.

Volvo is the second engine manufacturer in as many months to release a CARB 2024 Omnibus compliant engine, following Paccar’s MX-13 in June.

[Related: Paccar’s MX-13 now CARB Low-NOx-compliant]

FMCSA denies HOS waiver request

The Federal Motor Carrier Safety Administration has denied a specialized carrier’s request for an exemption from certain hours of service regulations.

Reiman Corp. late last year petitioned FMCSA to allow its drivers, who transport latex embedded in cement for use at highway construction sites, to operate under the same hours-of-service exception provided for “specially trained drivers of commercial motor vehicles that are specially constructed to service oil wells.”

Reiman said it considers its operations similar to that of oilfield operations, in part because “its drivers are specially trained to operate vehicles that are specially designed to transport specific products with vehicle-mounted equipment,” FMCSA’s notice said.

[Related: Specialized construction fleet seeks HOS exemption]

The company requested that its drivers be allowed to record waiting time at construction sites as “off-duty,” adding that waiting time would not be included in calculating the 14-hour period. If granted the waiver, Reiman drivers would not be eligible to use the short-haul provisions, the company noted.

In denying the request, FMCSA said Reiman did not include alternatives to compliance with the 14-hour rule, such as another fixed driving window during which all driving must be completed.

“The proposed relief from the 14-hour rule would enable miscellaneous off-duty periods at the construction sites to be excluded when determining whether the drivers may operate the CMV during the latter part of the workday,” FMCSA said. “This would create the potential for fatigued drivers, subject to long workdays and without consideration of whether the driver had accumulated 14 hours of on-duty time before completing their driving tasks for the day.”

[Related: Truckers mostly finding profit in the oilfield trucking niche]