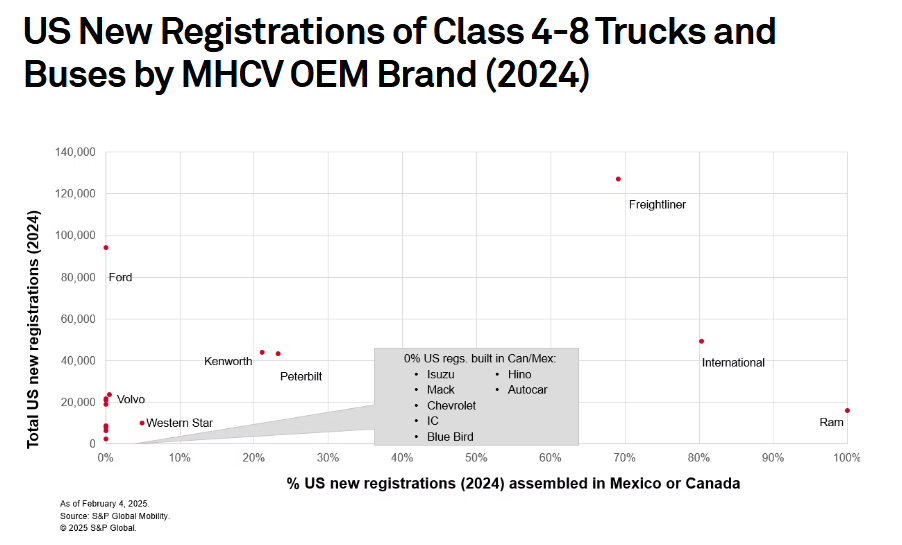

This week we received a report from S&P Global Mobility that examined the expected impact of tariffs on North American commercial vehicle demand.

ACT Research reported freight volumes softened in February, and also notes the worst of the trailer market downturn may be over. However, it adds the trailer market is now entering the typically slower stretch of order season so a rebound may not be in sight.

Flatbed rates continue to be the lone bright spot on the spot market, while reefer rates are at multi-year lows.

Tariffs to reshape CV market

S&P Global Mobility has put out a report on the impact tariffs will have on commercial vehicle sales. It anticipates a 25% tariff – expected to hit commercial vehicles April 2 — would affect about one third of U.S. commercial vehicle sales.

Combined with retaliatory tariffs from Canada and Mexico, there’s potential for depressed near-term truck sales and, over time, the reshaping of commercial vehicle manufacturing, S&P reports.

The share of Classes 4-8 trucks manufactured imported to the U.S. from Canada and Mexico now account for nearly a third of new vehicles. More than 40% of Class 8 trucks sold in the U.S. are imported from Canada and Mexico, S&P reported.

Some OEMs are more susceptible than others. Ram produces 100% of its vehicles in Mexico, while Volvo produces all its trucks in the U.S.

S&P reports commercial vehicle suppliers in the U.S. have “little or no” ability to absorb 25% cost increases. Meanwhile, big bore engines are almost entirely produced in the U.S. and shipped to Canada or Mexico for installation. (The report includes motor coaches and RVs).

“Even though it is difficult to calculate cost impacts all along the supply chain, this situation makes price increases for U.S. commercial vehicle buyers likely, should the U.S. enact the new tariffs,” S&P Global Mobility reports.

It anticipates the net impact of tariffs on new truck prices could be 9% and could depress demand for new commercial vehicles by as much as 17%.

“This would negate all of the previously expected growth this year and result in a down market in CY2025 compared to CY2024, all else equal,” it says.

S&P anticipates tariffs introduced in April will last four or five months, against the background of a renegotiated USMCA trade agreement.

“For the time being, amid the recent volatility surrounding enforcement, we maintain a ‘wait and see’ posture in the commercial vehicle forecast,” it said.

It anticipates Canadian commercial vehicle registrations to slide 3% this year before recovering 12% in 2026. The full report can be found here.

Freight volumes fall, but capacity contracts

ACT Research’s latest For-Hire Trucking Index showed falling freight volumes in February, but contracted capacity. The Volume Index fell 6.1 points to 48.1, from 54.2 in January.

“Trade policy uncertainty poses a risk to a weakening U.S. economy, and early data for 2025 show some signs of slowing growth,” said Carter Vieth, research analyst. “Retail sales were weaker than expected in January and goods inflation rose 3.1% y/y in January on tariff expectations. As a result of increased uncertainty, consumer confidence in March fell to its lowest levels in nearly three years.”

The Capacity Index increased 2 points to 47.1 in February, from 45.1 in January.

“Going on three years of weak profitability, this month is a continuation of what we’ve been seeing: for-hire carriers are continuing to shrink,” said Vieth. “Given the current volume and rate environment, we would anticipate for-hire capacity addition decisions to remain at or below replacement levels, leaving the index at or around a flat 50 level.”

The Supply-Demand Balance grew to 51.1 due to falling freight volumes and slower capacity contraction.

“Private fleet expansion, which is not captured in this indicator, has resulted in a longer period with the market close to balance than in past cycles,” Vieth said. “Goods inflation and a weakening consumer outlook due to tariffs may limit freight volume growth in the coming months. This situation could lead to weaker manufacturing/industrial output if enacted.”

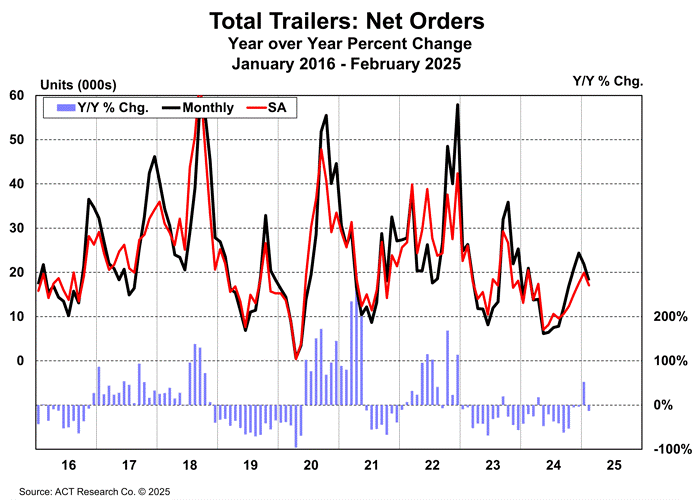

Trailer orders underwhelmed during peak order season

ACT Research’s latest State of the Industry: U.S. Trailers report suggest the worst of the trailer market downturn may be over, but now the industry moves into its traditionally weaker order season.

“Net orders are signaling that the worst of the downturn may be in the rearview mirror,” said Jennifer McNealy, director, commercial vehicle market research and publications at ACT Research. “However, we caution that the industry’s annual period of seasonally stronger order months is ending, and weaker intake months are expected as we move into the late spring/summer, amid tariff uncertainty that is likely extending the ‘pause’ on ordering decisions.”

“We’re hearing from those on the trailer industry’s frontlines that general economic concerns in the face of tariff ambiguity and its ongoing impact on the freight markets are causing customers to delay ordering,” McNealy added. “With weak profits and still-soft freight rates, fleet decision makers are reluctant to pull the trigger on large capital investments until the dust settles and the operating environment becomes clearer.”

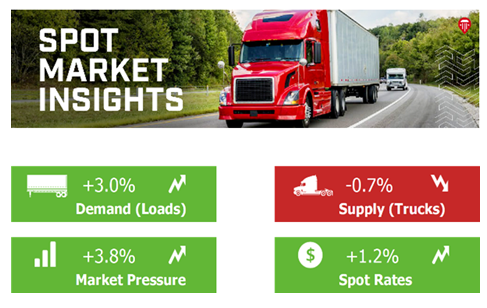

Flatbed rates continue to lead spot market

Truckstop and FTR Transportation Intelligence reported more of the same for the spot market in the week ended March 21, with flatbed rates rising for the ninth time in 11 weeks and dry van and refrigerated rates falling for the ninth time in 10 weeks.

Flatbed rates have hit their highest level since June 2024, while reefer rates hit their lowest since June 2020. Van rates are only about two cents/mile higher than they were in June 2020.

“Load volume rose during the week, primarily due to flatbed, although refrigerated load postings were also up,” Truckstop reported. “Continued strength in flatbed loads beyond the March 12 implementation of steel and aluminum tariffs suggests that flatbed volume probably was not being driven recently by metals imports ahead of tariffs, as we speculated last week as a possibility. Flatbed load volume declined modestly in the Southeast in the latest week but rose in all other regions.”

The Market Demand Index rose to 100.4, which is the strongest level since June 2022. Flatbed remains the principal driver for the rising MDI, although refrigerated equipment also contributed during the latest week.