For-hire truck tonnage was flat in January, despite harsh weather and a major winter storm in the southern states.

Trailer orders spiked but buyers should brace for the impact tariffs will have on trailer pricing. And the spot market has settled into seasonal norms.

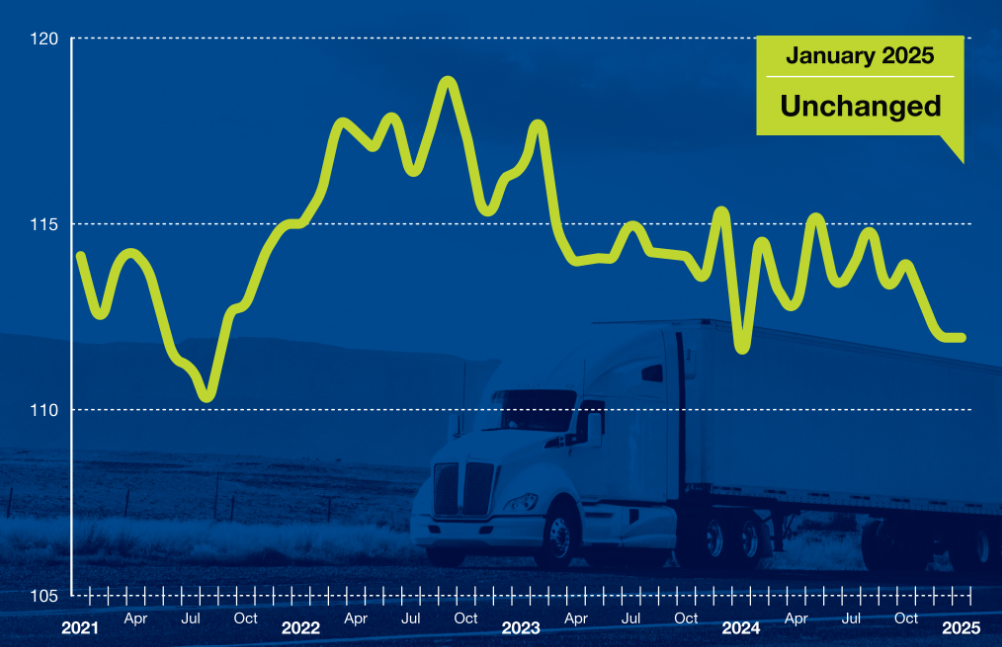

Truck tonnage unchanged in January

U.S. for-hire truck tonnage was unchanged in January, with volumes hurt by harsh winter weather and a natural disaster.

“After declines in November and December totaling 1.7%, tonnage was unchanged in January,” said ATA chief economist Bob Costello. “This outcome is impressive considering the massive winter storm that brought cold temperatures and significant snowfalls to large parts of the country, including those that rarely see such storms. Furthermore, the terrible wildfires in California likely also caused freight disruptions. Softness in manufacturing and retail sales continue to be a drag on truck freight volumes as well, so the fact tonnage was flat is a positive sign.”

Tonnage was up 0.3% year over year, marking the first YoY increase since August.

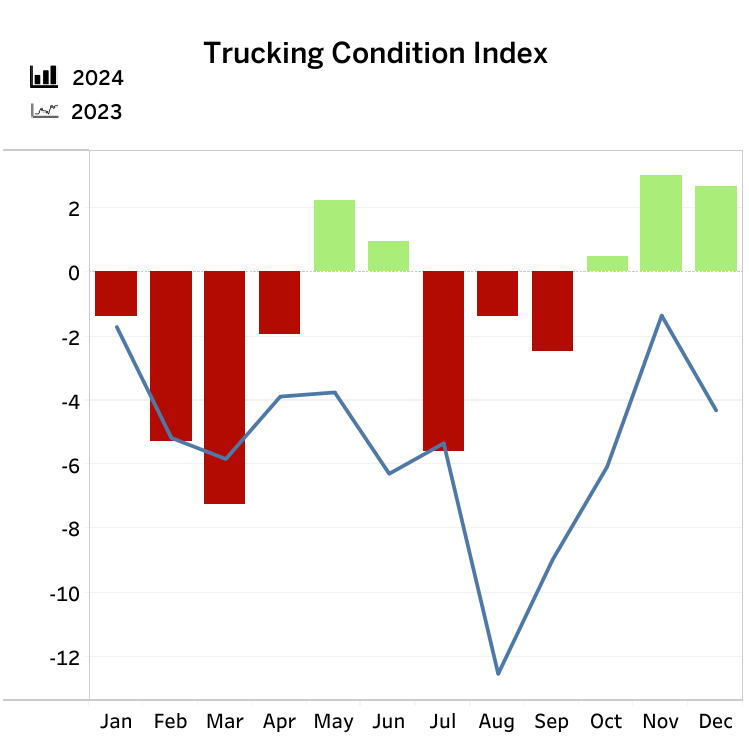

Trucking conditions slid in December

FTR’s Trucking Conditions Index (TCI) slid from 3.02 in November to 2.67 in December. The index, which measures metrics affecting trucking conditions, was down because of lower freight rates, even though freight volumes and capacity utilization improved.

FTR is projecting near-term weakness due to fuel prices and freight rates, but anticipates the index will be consistently positive by Q2.

“Preliminary data suggests that market conditions were tough for carriers in January, but we still forecast consistently favorable market conditions for carriers to begin soon,” said Avery Vise, FTR’s vice-president of trucking.

“Freight rates have been sluggish, however, so the risk of a slower recovery than currently forecast is significant. Volatility in economic data due to tariff expectations and response from businesses and consumers injects further uncertainty into the outlook. Despite these concerns, we are confident in modestly stronger conditions for trucking companies at least by the second half of the year.”

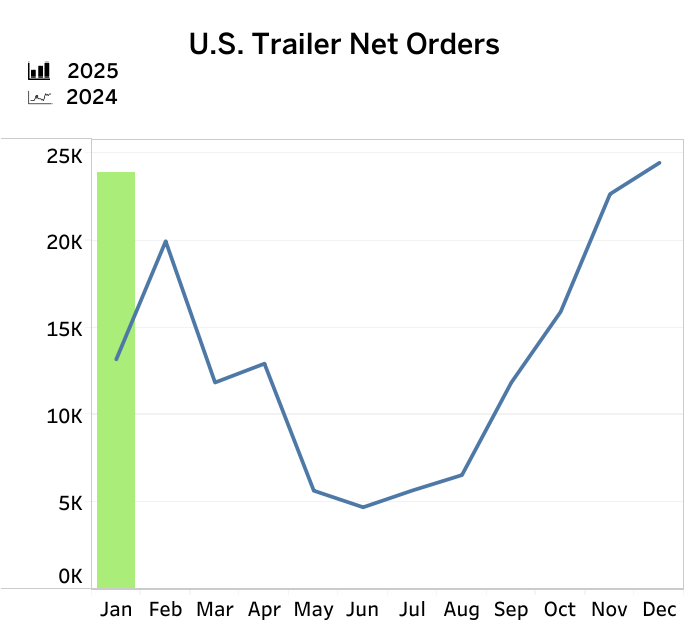

Trailer orders surged in January

Trailer orders were up 81% year over year in January at 23,966 units, although down 2% from December levels, according to preliminary data from FTR. The 2025 order season – defined as September 2024 to January 2025 – was down 21% year over year at 98,926 units.

“Many fleets continue to prioritize purchasing power units over trailers – a trend unlikely to reverse given the approaching implementation of EPA’s 2027 NOx regulations on trucks,” said Dan Moyer, senior analyst, commercial vehicles. “During the 2025 order season so far, North American Class 8 net orders are up 4% year over year while U.S. trailer net orders are down 21%. Trailer OEMs have scaled back production, and prolonged cuts are possible if demand remains weak.”

He continued: “Tariffs threaten further disruption. The 25% tariffs on steel and aluminum imports planned to take effect next month along with the 10% additional tariff already imposed on Chinese imports and the currently paused but still possible 25% tariffs on Canadian and Mexican imports will raise material costs, squeeze margins, and strain supply chains. Tariffs will affect not only fully assembled trailers imported into the U.S. but also domestically produced trailers, which depend on imported materials and components. Expect market volatility as OEMs try to adapt to uncertainty over scope and timing of tariff impacts.”

ACT Research reported 21,300 orders in January, down 3,100 units from December but up more than 51% year over year.

“Though past the traditional peak, we’re still in a period of ‘strong order’ intake. This month’s pattern of lower-than-December but still above average demand was expected,” explained Jennifer McNealy, director of commercial vehicle market research and publications at ACT. “It’s also no surprise that the data are higher than the January 2024 intake, given the slowing demand that marked 2023 and led into the subdued market reported throughout most of 2024.

“Notwithstanding the improvement thus far in the 2025 order cycle, ACT’s expectations for weak trailer demand relative to recent performance remain, as continuing weak for-hire truck market fundamentals, low used equipment valuations, relatively full dealer inventories, and high interest rates impede stronger activity in the near term.”

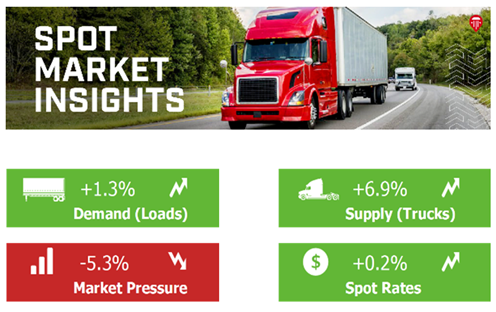

Van spot market rates continue to settle

Truckstop and FTR Transportation Intelligence reported continued easing in spot market rates for the week ended Feb. 14. Declines to dry van and reefer rates were in line with seasonal expectations.

Van rates were at their lowest level since late September while reefer rates were at their lowest level since April. However, flatbed rates continued to firm and reached their highest levels since late October. Rates for all three segments were slightly below comparable 2024 levels, Truckstop reported.

“With the week-over-week increase in truck postings exceeding that for load postings, the Market Demand Index declined to 73.8, which is still higher than the MDI during most of 2024. Overall load volume is still running above comparable 2024 weeks due solely to flatbed,” Truckstop reported.