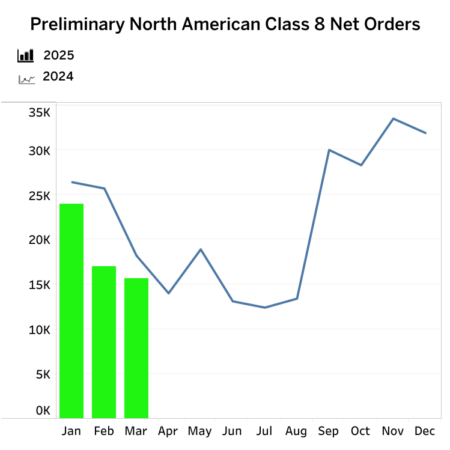

Class 8 orders were weak in March and could stay that way, as the potential elimination of EPA27 emissions regs could also sink any hopes of a pre-buy.

Spot market rates, however, were higher across the board last week.

Class 8 orders sink

Class 8 truck orders fell another 14% in March, to 15,700 units according to preliminary data from FTR. They were also down 22% year over year and were well below the seven-year March average of 24,760 units.

FTR blames economic uncertainty and the imposition of tariffs by the U.S., as well as anticipated revisions of the EPA27 NOx regs.

“Persistent uncertainty in tariffs, the economy, freight, and regulations could notably disrupt fleet replacement cycles – potentially prompting fleets to either accelerate purchases ahead of expected price hikes or, more likely, delay investments until market conditions stabilize,” said Dan Moyer, senior analyst, commercial vehicles.

“The latter scenario appears supported by the 25% y/y decline in net orders for 2025 to date. Cumulative net orders for the 2025 order season (September 2024 through March 2025) were down by 8% y/y as well. New and pending U.S. tariffs and retaliatory tariffs are expected to significantly increase costs for North American Class 8 trucks, tractors, and related components. OEMs and suppliers may consider shifting production to mitigate tariff exposure, but such strategic adjustments are costly, complex, and time-consuming, further complicating industry planning.”

ACT Research reported 16,000 orders and similarly blamed uncertainty for the weak month.

“The first quarter of 2025 has been defined by one word: uncertainty,” said Carter Vieth, research analyst at ACT Research. “Whether the slowdown in orders is a result of moderating economic activity, private fleets’ pausing expansion, or a response to trade and policy uncertainty is difficult to surmise and remains an open question.”

Regarding medium duty, he added, “ACT’s preliminary look at March NA Classes 5-7 orders put the month’s volume at 18,600 orders, down 33% year over year.”

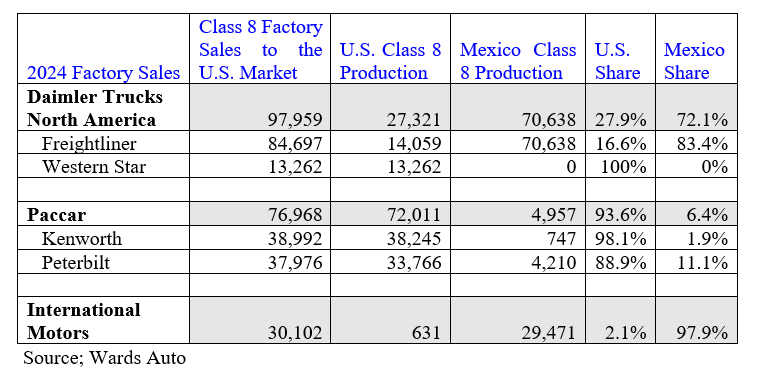

It could get worse for truck makers

And it could get a lot worse for truck builders, according to a recent analysis by CMVC, which reports an uncertain freight environment, tariffs, and the possible end of EPA27 emissions regs – and the expected associated pre-buy – could drive Class 8 truck demand down further.

CMVC reported 105,066 of the 144,785 Class 8 factory sales last year were for trucks built in Mexico.

“The trade war will also have large implications on the freight environment, as a result Class 8 truck demand,” the analyst said. “In CMVC’s opinion, the trade war will do more harm than good to the U.S. economy resulting in a soft freight environment. Higher import prices will weigh on the growth rate of consumer spending, which has the largest pull upon the supply chain. Higher import prices will also increase businesses input prices and costs that cannot be passed along to customers will reduce operating margins, slowing business profits.”

In response to slowing profits, businesses will adjust investment spending, CMVC anticipates.

“U.S. Class 8 retail sales rate in the first two months of the year was 224,800 units, seasonally adjusted annual rate, as compared to 258,886 units, seasonally adjusted annual rate, in the first two months of 2024,” it reports.

“The decline in U.S. Class 8 retail sales rate was a result of fleets in linehaul applications rationalizing capacity in 2024 in response to the soft freight environment. Linehaul fleets have brought capacity in equilibrium with the soft freight environment, but have spare capacity available in the near term to meet moderately higher freight volumes, so Class 8 truck sales will remain soft in the near term. The trade war is capable of keeping the freight environment soft for an extended period of time, limiting upward pressure on fleets to expand capacity, thereby keeping Class 8 truck sales soft for an extended period of time as well.”

CMVC also noted dealer inventories are high and in the absence of a pre-buy, OEMs will need to work through significant stock.

“ If there is no Class 8 pre-buy and Class 8 truck sales remain soft then truck deliveries must fall below truck retail sales in order to bring Class 8 stocks in equilibrium with the sales environment, resulting in large decreases in Class 8 production,” it reports.

“In conclusion, the trade war has micro implications upon OEMs’ truck assembly plants as well as macro implications with respect to Class 8 demand and the truck production outlook is further complicated by excessive Class 8 truck inventories and the possible elimination of a truck pre-buy, if the Trump Administration eliminates or substantially alters the 2027 model year truck emission standards,” CMVC concluded.

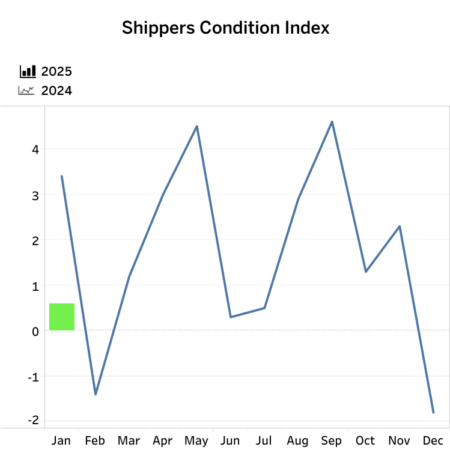

Shipper conditions improved

Meanwhile, shippers saw conditions improve to positive territory in January, according to FTR’s Shipper Conditions Index (SCI). The improvement was due to improving freight dynamics for shippers related to utilization, rates and volume, partially offset by higher fuel prices.

“Broadly speaking, the freight market is still fairly comfortable for shippers despite softening over the past few months,” said Avery Vise, FTR’s vice-president, trucking.

“However, conditions vary depending on freight profiles. For example, in the spot market for truck freight, 2025 has been rather sluggish for dry van and refrigerated equipment but has been increasingly hot for flatbed. In rail, carload volumes have been only marginally stronger than comparable 2024 weeks, but intermodal is still running strong year over year. Tariffs and anticipation of tariffs likely are big components of these distortions, and it will be advantageous for the whole supply chain to have clarity and certainty soon.”

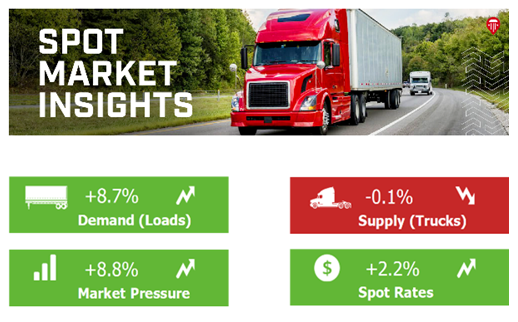

Spot market rates increase

For the week ended March 28, spot market rates were up across the board, according to Truckstop.

“Dry van and refrigerated spot rates in the Truckstop system both increased week over week for the first time in five weeks and for only the third time this year,” the company reported. “Despite modest gains, rates for both equipment types are not much higher than they were in June 2020. Meanwhile, flatbed spot rates increased for a seventh straight week to their highest level since June 2023.”

The Market Demand Index rose to 109.2, the strongest level since June 2022. Flatbed accounts for the principal strength in the MDI, as well as in rates and load volume, Truckstop said.