COMPANY REVENUE LOAD REPORTS - USEFUL FOR OWNER OPERATORS

OPEN / CLOSE - (CLICK HERE)

This shows the Load Reports submitted into the app for the requested year. Accurate tax records are critical in the trucking industry, covering areas like fuel taxes and heavy vehicle use tax. Proper record-keeping ensures legal compliance and provides valuable financial insights. Technology simplifies this process with software and apps for real-time tracking of income and expenses. By fostering accountability and using these tools, tax records become more than a compliance requirement—they become a powerful resource for financial growth.

Success Academy Profit Training for Company Truck Drivers

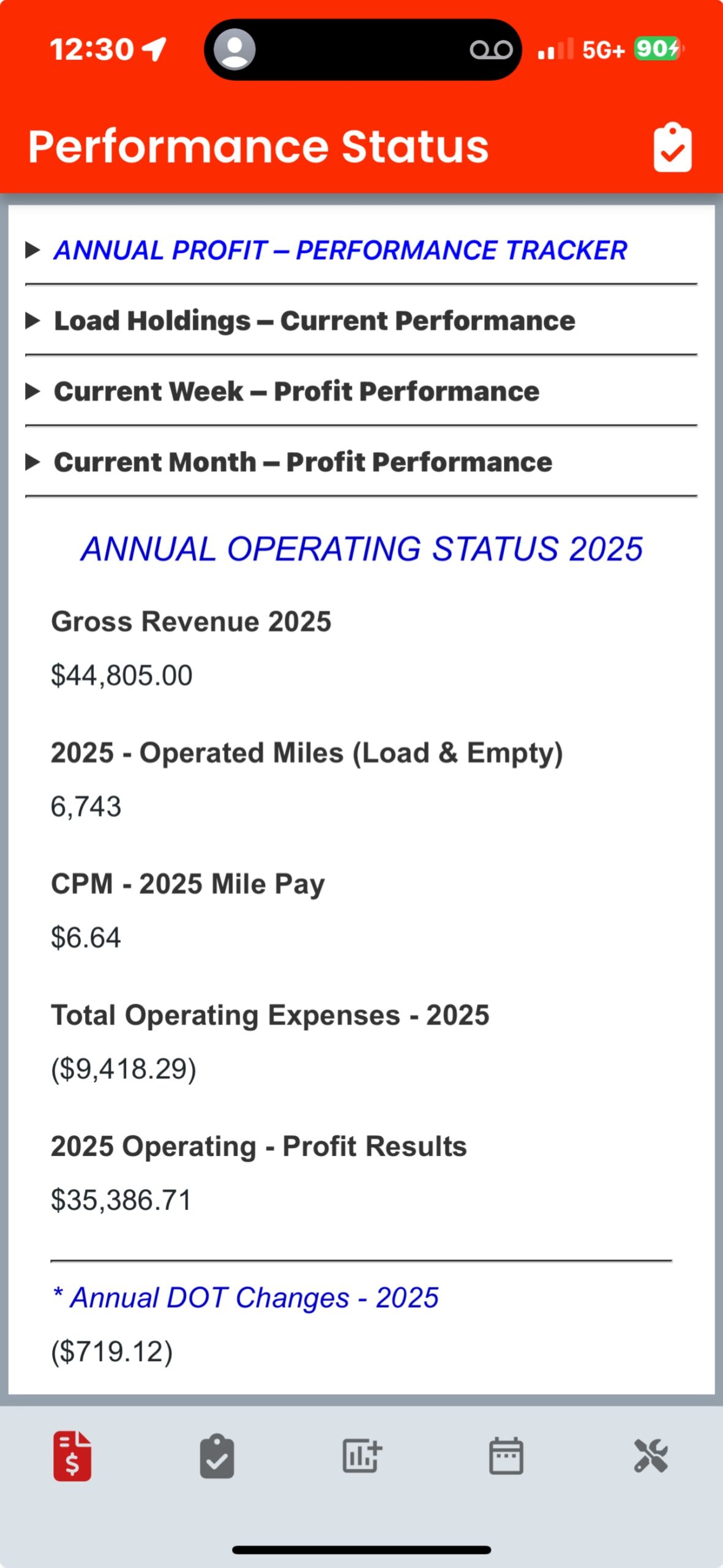

$44,000 for just 6,743 total miles, Net Profit $35,386.71

These systems give you the power to help clients master the trucking industry from a driver's perspective and build profit focused habits that consistently grow your net income. They'll quickly adapt to fuel price changes and market rate fluctuations, book smarter loads that boost profits, and do it all from behind the wheel, giving you the real freedom of independent success.SUCCESS ACADEMY

AI POWERED TO BUILD PROFITS THROUGHOUT FUEL AND MARKET FLUCTUATIONS

Independent Success is about Knowing How to Increase how much you Take-Home in Pay (Net Profits)! Below are your Training Goals in Action.

We're training you to understand how to effectively achieve results like below once you become independent. As a Company Truck Driver, you'll learn why so many trucking companies big and small, are failing. You'll also see why Company Drivers are at high risk of losing everything. Your livelihood sits in the palm of someone else's hands, and their operating decisions could lead to major financial hardship. Why? Because profit building isn't taught from a driver's perspective. Most systems used today were built by people who've never driven a truck causing costly mistakes and massive losses. Most companies are operating at the level shown below. Are You at risk?

We're training you to understand how to effectively achieve results like below once you become independent. As a Company Truck Driver, you'll learn why so many trucking companies big and small, are failing. You'll also see why Company Drivers are at high risk of losing everything. Your livelihood sits in the palm of someone else's hands, and their operating decisions could lead to major financial hardship. Why? Because profit building isn't taught from a driver's perspective. Most systems used today were built by people who've never driven a truck causing costly mistakes and massive losses. Most companies are operating at the level shown below. Are You at risk?

Settings